Free Template Resource for Your Business

Uroom Surf

Help Your Work and Business, Free Editable Templates to Get your Work more Faster

Free Download and Easy to use Templates.

Why Choose Us?

10.000 Templates Ready To Use

#1. Template For Business

Resume, Job Description, Business Letter

#2. PSD Template Ready yo Use

Banner, Book Cover, Brochure, Catalog, Certificate,

#3. Printable Template

We Have 2000+ Word and Excell Template Ready to Use

Testimonials

Trusted by Thousands of Worker and Company

4.8

“I always use template for my office, Free Template and Easy to Use.”

Eza Hart

“Ut morbi felis, felis massa quam sit massa, amet, bibendum pulvinar elit in adipiscing amet imperdiet ac felis congue enim, elementum orci.”

Freddie Jonson

“Amazing collection of free PSD design resources and Easy to .”

Jonathan

This website collects and offers hundreds of PSD file

Edward

New Template Collection :

10+ Printable Recipe Card Template for Your Cooking Adventure

A printable recipe card template allows you to create unusual dishes. The recipe card contains…

10+ Printable Monthly Calendar Template to Welcome the New Year

A monthly calendar is a system for naming a period of time consisting of twelve…

10+ Printable Certificate Template, a Quick ‘Assistant’ in Making Your Certificate

If you attend an event, certificate is one of the things people would expect, especially…

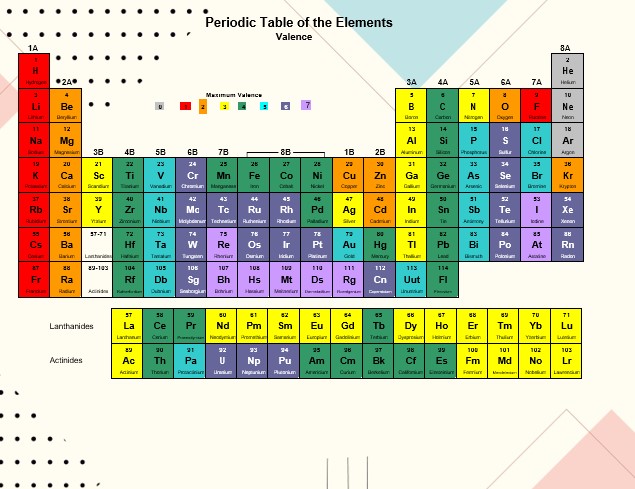

10+ Printable Periodic Table Template of Elements is the Most Important Basis of Chemistry

Printable periodic table of elements is a form containing information about chemical elements that can…

10+ Template Weekly Menus Printable for Household and Schools

Using printable weekly menus is usually done by home cook or caterer to make sure…

10+ Printable Behavior Charts Template for Adults, Kids, and All Age

Well, downloading the free printable behavior charts are important, especially for parents or homeroom teachers…