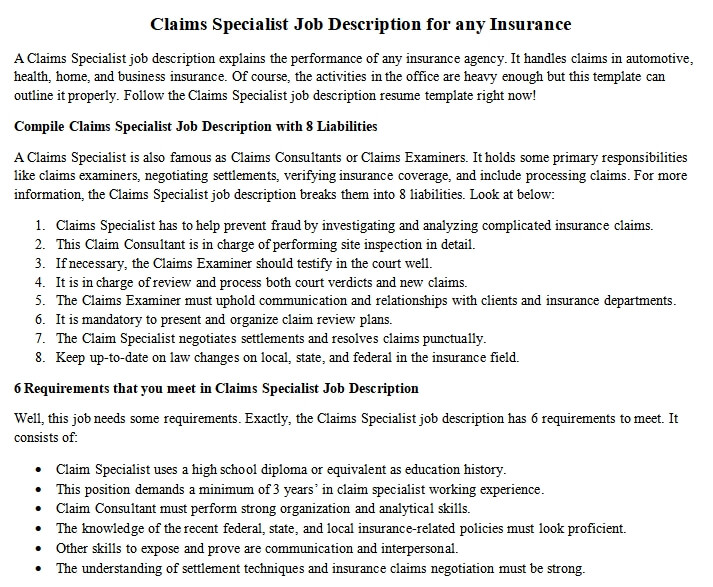

A Claims Specialist job description explains the performance of any insurance agency. It handles claims in automotive, health, home, and business insurance. Of course, the activities in the office are heavy enough but this template can outline it properly. Follow the Claims Specialist job description resume template right now!

Compile Claims Specialist Job Description with 8 Liabilities

A Claims Specialist is also famous as Claims Consultants or Claims Examiners. It holds some primary responsibilities like claims examiners, negotiating settlements, verifying insurance coverage, and include processing claims. For more information, the Claims Specialist job description breaks them into 8 liabilities. Look at below:

- Claims Specialist has to help prevent fraud by investigating and analyzing complicated insurance claims.

- This Claim Consultant is in charge of performing site inspection in detail.

- If necessary, the Claims Examiner should testify in the court well.

- It is in charge of review and process both court verdicts and new claims.

- The Claims Examiner must uphold communication and relationships with clients and insurance departments.

- It is mandatory to present and organize claim review plans.

- The Claim Specialist negotiates settlements and resolves claims punctually.

- Keep up-to-date on law changes on local, state, and federal in the insurance field.

6 Requirements that you meet in Claims Specialist Job Description

Well, this job needs some requirements. Exactly, the Claims Specialist job description has 6 requirements to meet. It consists of:

- Claim Specialist uses a high school diploma or equivalent as education history.

- This position demands a minimum of 3 years’ in claim specialist working experience.

- Claim Consultant must perform strong organization and analytical skills.

- The knowledge of the recent federal, state, and local insurance-related policies must look proficient.

- Other skills to expose and prove are communication and interpersonal.

- The understanding of settlement techniques and insurance claims negotiation must be strong.

Bonus: How to interview Claims Specialist Candidates

There is little assistance to smooth the run of the interview session from this template. Use the most effective and efficient times by giving high-quality questions. Do not waste time but save it by asking about:

- How to priority cases coming together to know how to highlight their organizational skills.

- The company wants to know the candidate approach clients to negotiate. Make a good question to test their negotiation skill.

- Ask about how to settle the challenged claim and find out the method to use. It will inform on their prior working experience.

- You need to know how they analyze a large amount of data. It is useful to test their analytical skills.

- The company wants to know the way to convey its failure in client claims. It needs to demonstrate interpersonal skills.

Thank you for reading, following, and perceiving Claims Specialist job description. During working from home and staying at home you can learn this template. Learn properly and practice to recruit new staff. Good luck!

FAQ:

- What is a Claim Specialist?

The Claim Specialist with other names of Claims Examiner and Claims Consultant works for any insurance agencies. It handles claims from health, automotive, business, and home insurance industries.

- What are 4 chief Claim Specialist liabilities?

It is in charge of verifying insurance coverage, negotiating a settlement, reviewing insurance cases, and processing claims.

- How long does the Claim Specialist working experience?

This profession just asks for at least 3 years in the claim specialist field as the prior experience.