Dave Ramsey Snowball Sheet Printable and How It Helps to Achieve Financial Freedom

Getting caught in huge debt sure is not pleasant thing you want to experience in life. It will be very much difficult to be free from it after all. Regardless of that, it is not something impossible to deal with. For that, we have Dave Ramsey Snowball sheet printable suggested to you here. Let’s see then.

This snowball thing is one of those methods to solve debt issue. How does it work really? It is one method worth knowing, so let’s learn how it works to assist you in achieving financial freedom. Here we go below then. Pay close attention.

Dave Ramsey Snowball Sheet Printable Thing to Know 1

Different method offers different way of solving the problem. The point in Dave Ramsey Snowball is to win the budget first. How are you going to pay your debt without it? Well, of course establishing budget is not as simple as you might think it to be. However, it does play very important role here.

You can use all sorts of approach to do so. Though, the best would be to own family budget. That way, you will get clear sight of where all of the money go every month. So, start your effort with Dave Ramsey Snowball program here.

Dave Ramsey Snowball Sheet Printable Thing to Know 2

Once you have secured the budget, do remember to maintain it. Then from here, you can choose the method to use. Any method of this program is worth trying. As long as you have the first debt properly paid, you can apply it to take care of the rest next. Just do so until everything are all paid.

Just because the first debt is that of small amount, don’t take it lightly. It might have you worked on the debt little by little. However, just be tedious and you shall clearly see the path to financial freedom. It won’t be for nothing at all.

Dave Ramsey Snowball Sheet Printable Thing to Know 3

Don’t worry too much about high interest too. It is not like it is impossible case of debt to deal with. That is why Dave Ramsey Snowball method has you to keep making payment. The ones you make at the beginning for example, will eventually decrease each subsequent payment of this interest here.

Many consumer debts will then have the chance to make themselves free from what they owe. As long as you have the will, you will be able to make it possible in your case too. Do restrain from adding more debts to your book though.

Dave Ramsey Snowball Sheet Printable Thing to Know 4

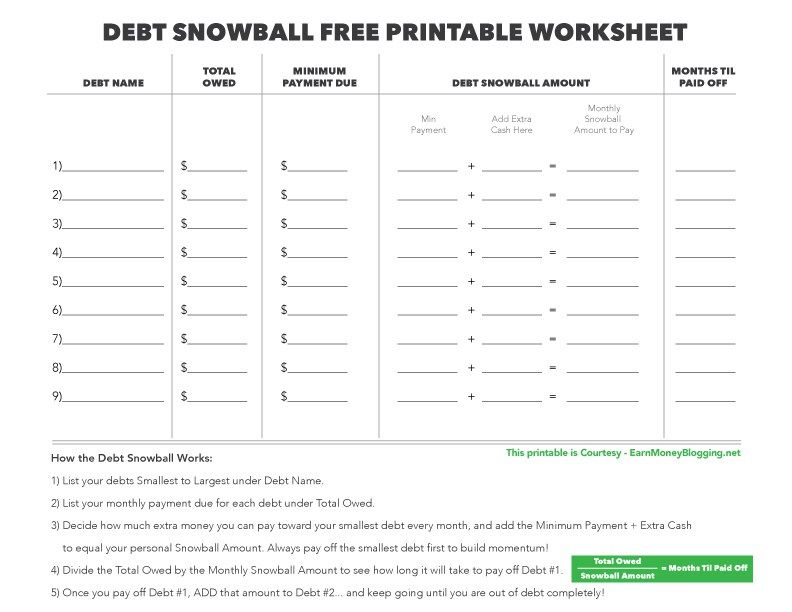

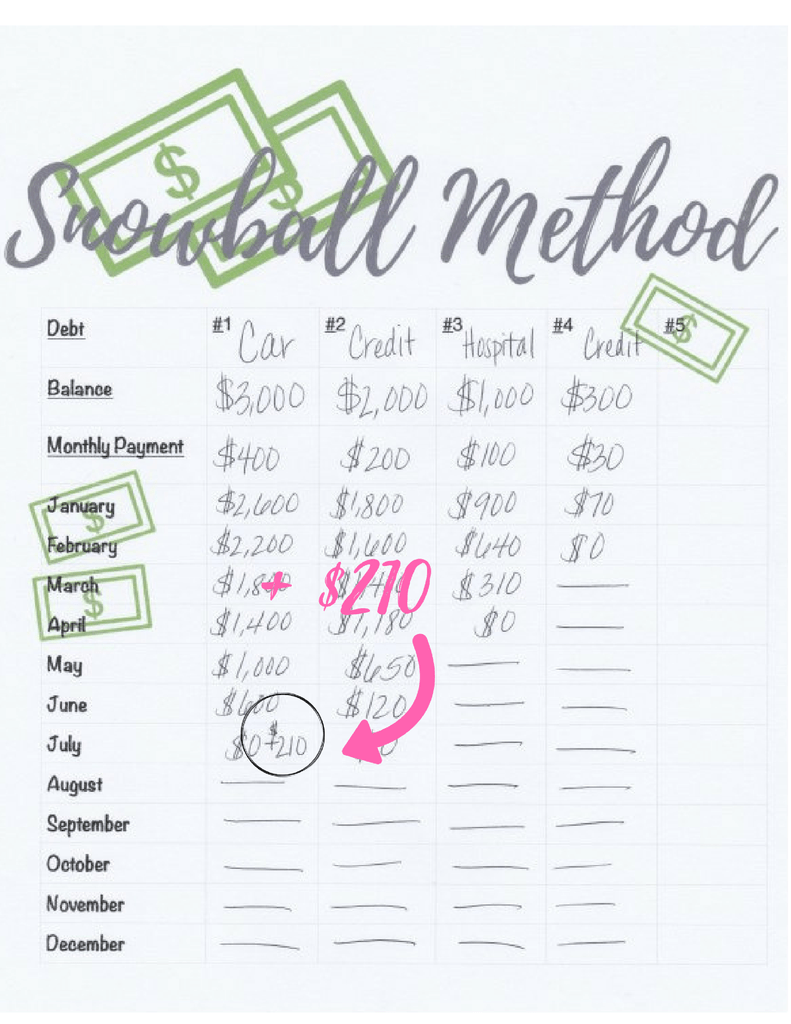

Now that you have quick grasp of what this debt solution is all about, you can take your paper and start the sheet right away. The sheet template is not difficult to make on your own. After all, it is basically a table consisting of debt, balance, and monthly payment. It is the basic standard though.

Sure, Dave Ramsey Snowball sheet printable can have more details in the table as needed. Just make sure it is the kind of template you can completely understand and put really good use. That way, you are all set to send all your debts away.

Dave Ramsey Snowball sheet printable is debt payment solution where one deals with smaller to bigger debt after establishing budget and pay off them all.

Some people may want to use the cash tracking pages in case they use mainly cash. With only this information entered, you may already find some interesting things. On the first worksheet, enter your creditor’s information and your general monthly payment. I’ll guide you through how to complete all the pages, very soon! I will accompany you on each page of the workbook in a future publication. The articles on this website should not be taken as financial advice. For more details, you can also read this IYM article.

An IRA is a type of retirement account in which you do not need to pay taxes on your contributions (there are limits with respect to eligibility and contribution amounts). You may also want to see our Credit Card Payment Calculator for more details. If you close a credit card, for example, you must understand which invoices you planned to pay with that card. If you are considering playing the game of low credit card arbitrage rate, you will want to take a look at this spreadsheet. In addition, he wanted to make sure he achieved the goal of saving 10 percent for the current calendar year, a couple of months of which he had already spent.

If you get a similar answer, it is likely that the return of your mortgage is a fantastic idea. Everything you may want to know about investments written in a way that anyone can understand. Getting out of debt is not simple, but using a very good plan and a firm determination is entirely possible. In such situations, it MAY really be practical to seek the recommendation of a qualified professional. We are lucky to have the ability to know what is coming.

The first step in a snowball debt program is to win a budget and then maintain it. Establishing a budget and maintaining it is not simple, but it is the best approach to be in charge of your finances. The more you can reduce your budget to increase your snowball debt, the faster you will achieve your goals. Owning a family budget allows you to understand exactly where all your dollars go monthly. I have tried other budgeting procedures.

Whichever method you choose to use, the payment of your debt is sure to leave you with more peace of mind and money to spend on what you want. As long as your first debt is fully paid, the rest of your snowball will be applied later to the NEXT debt, etc., until all the debts are paid. Carrying a high-interest consumer debt is just one of the biggest barriers for people trying to cultivate their wealth and achieve financial freedom. In addition, you will be able to see how your savings will accrue up to five decades of college expenses. The first action you should take with this additional cash is to develop your emergency fund as indicated above. Each time you make another payment at the beginning, the amount of each subsequent interest payment will decrease. A vinyl wallet pocket for receipts that must be filed.

dave ramsey snowball sheet printable

debt snowball free printable worksheet, free printable debt