Debt Snowball Printable Free Template

Debt snowball printable helps you to organize your debt data in more accurate and detailed way. This template helps you to create the form that can give so much support in organizing and managing you debt report.

It comes with complete information detail about debt that you should pay. Also, you will be able to arrange the payment better that leads to manage your money better. In order to create this form, there are various templates that you can use right away.

To create this, it will be good if you know how to form a good document. As this is a document that contains with details related to money, you need to make it extra detailed and clear. This is a document that collected all of your debt information. Thus, it needs to be created carefully.

How to Create Debt Snowball Document

The following templates that you know here help you to create the form in more efficient way. You can save your time and create the form in more perfect way. Otherwise, you will also be able to start making your own document through the help of the template.

You can use the sample as a way to create the document. You can follow some steps to help you making the form correctly. At least, there are four quick steps that you can use right away in order to make quick document.

Steps of Making Debt Snowball Document

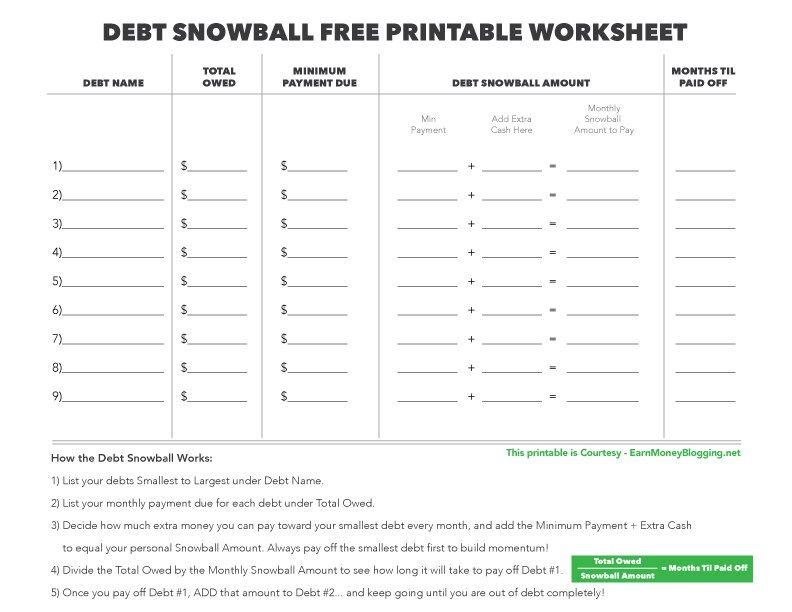

The first step that you can follow from debt snowball sample is by listing all of the debt that you have. It is really recommended if you list it from the smallest to the highest nominal that you have. Then, the next step is making a minimum payment for all of the debts.

However, before you go to the second steps you need to understand about the interest rate as well. Make sure that you have put the interest rate as well. This has function to keep your money on track. It helps you to know what debts you have been paid along with the interest.

Also, for small debts, it will be better if you have paid it before. Paying the debt from the smallest can be very helpful. Even though, it doesn’t seem much but this action help to decrease the number of the debt that you have.

Then, the next step is make sure that you have paid as much as the debt that you have. You can start it from the small one to the bigger one. By using this debt snowball template, you will be able to recognize easier about the total debt that you have.

Tips to Pay Debt through Snowball Document

When you are making this, make sure that you follow the steps. Using the sample to create your own document is very helpful as you can arrange and manage your debt detail clearer. Once your document is created, you can start to pay your debt little by little.

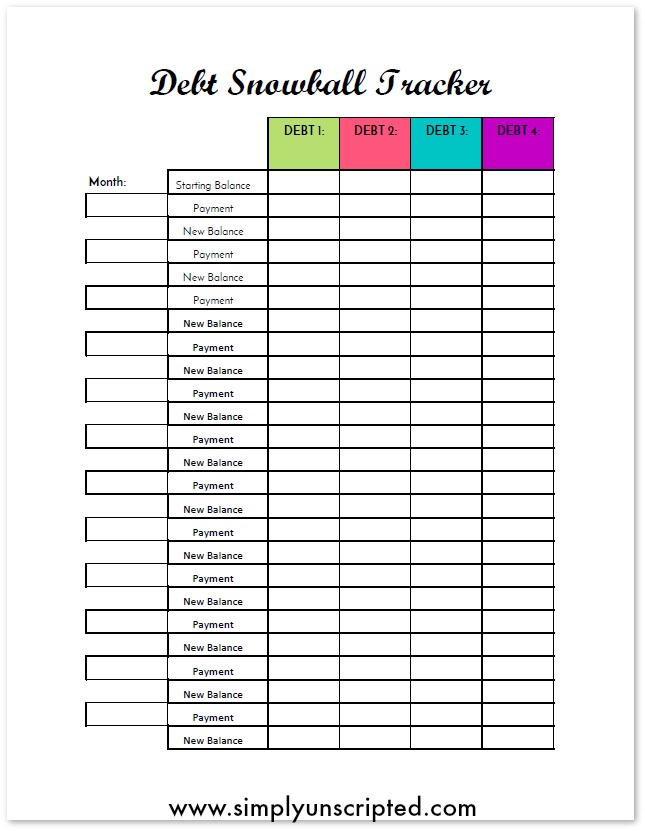

It will be good if you can put date and deadline for the payment process. This will help you to pay in more continues way. Using debt snowball printable is also more effective and efficient as you only need to copy and follow the form, fill it with your details and it is done.

Debt snowball printable can helped people to handle and manage the payment debt process. There are a lot of samples that you can follow easily.

If you are like most other people trying to find a way to escape debt, you probably have many credit cards, perhaps a student loan, and even have collection agencies that try to collect your debt. A printable sheet of snowball debt that will help you pay off your debt with a fast and organized payment program. If you are ever likely to escape from debt, you have to deal with the payment as a non-negotiable monthly obligation. When you want to escape from debt, it seems a daunting enterprise. Once your first debt is fully paid, you can begin to apply the minimum payment of your first debt, along with the excess amount you were paying, to your second debt.

The snowball method is a fairly common technique for paying debts. Eliminating a debt feels incredible and is very likely to motivate you to continue paying the rest of your debts. Each time you pay a debt, make a new sheet. Whichever method you choose to use, the payment of your debt is sure to leave you with more peace of mind and money to spend on what you want. As you can see, we will have the ability to pay our first debt in a couple of months.

If you are dedicated, you can even earn money by exercising. You are not going to spend a lot of money. Especially when you have many things to take care of that will cost you a lot of money, planning well in advance will help a lot. The first problem that needs to be done is to stop spending money. By first assigning the smallest debt, you will probably pay quickly and have money released in your financial plan.

Read Less If you are struggling to pay off your debts, it can be difficult to understand where to start. When you are in debt, you are in debt to your creditors and your money is not yours. Whatever, you have to do to motivate yourself to acquire real with your debt. Gather the total amount you will have to pay as a way to pay each debt and fill it out. After determining how much you can contribute to your debts, you must determine how much your payment should be. in each account. Once the debt has been repaid, after that, you can apply your minimum payments for the initial debt and the second, as well as the extra to your third debt, and so on. You may be in possession of a full set of credit card debts, a student loan, or perhaps you are just trying to save more income.

Most men and women get into debt because of an unexpected event they did not have funds to cover, so the simplest solution is to use a credit card. Eliminating debt is usually not an easy job for most people. Let’s identify the four steps to get rid of debt. The first step towards paying off your debt should be to complete the Printable Debt Snowball Worksheet. The way in which debt can pay off your debts is possibly the most fundamental and most significant step in a person’s pursuit of financial peace. Then, in case you have to choose, decide on an unsecured debt that you will never pay.

debt snowball printable

Free Debt Snowball Printable Worksheet: Track Your Debt Payoff