Pay first, even if you are in debt. After determining how much you can contribute to your debts, you must determine how much your payment should be in each account. As you can see, we will have the ability to pay our first debt in a couple of months.

Balancing your budget can be a painful procedure, but it can be quite easy. It is crucial that you meet your budget and not generate new debts of any kind. To get rid of debts, you want to get a program. Sooner or later, something will often happen that will cause the strategy to collapse. By using the snowball method of debt, you simply stick to the plan shown above until all your debts are paid. Especially when several strategies are used over a long period of time.

If you are like most other people trying to find a way to escape debt, you probably have many credit cards, perhaps a student loan, and even have collection agencies that try to collect your debt. Most people get into debt because of an unexpected event they did not have funds to cover, so the simplest solution is to use a credit card. When you begin to eliminate the easier debts, you will begin to find results and start earning in debt reduction.

Whichever method you choose to use, the payment of your debt is sure to leave you with more peace of mind and money to spend on what you want. Eliminating debt is usually not an easy job for most people. Let’s identify the four steps to get rid of debt. The way in which snowball debt pays off your debts is probably the most fundamental and crucial step in someone’s search for financial peace. The sum of the debt can also affect the possibility of liquidation. Then, when you have to choose, decide an unsecured debt that you will never pay.

Many people do not expect to observe how all small purchases go up at the end of the month. Now you must decide the order to pay your bills, because if your world has collapsed, you probably do not have the money to pay them all. Next, you must decide on the correct purchase.

If you are dedicated, you can even earn money by exercising. There are many ways to save money and it requires an effort to be more aware of how you spend on what. Yes, but it is important to ensure that the money is placed in strategic locations and matches an adequate money claim. By first assigning the smallest debt, you will probably pay quickly and have money released in your financial plan. With the simplicity of online banking, it is simple to transfer money between a checking account and a line of credit. The first problem that needs to be done is to stop spending money. Starting a blog can be an excellent method to earn money aside.

In prayer, it is lower than your earnings. Revenue has become the most vital part of any financial planning. It is possible to observe where you can cut expenses to manage your home with money remaining at the end of the month.

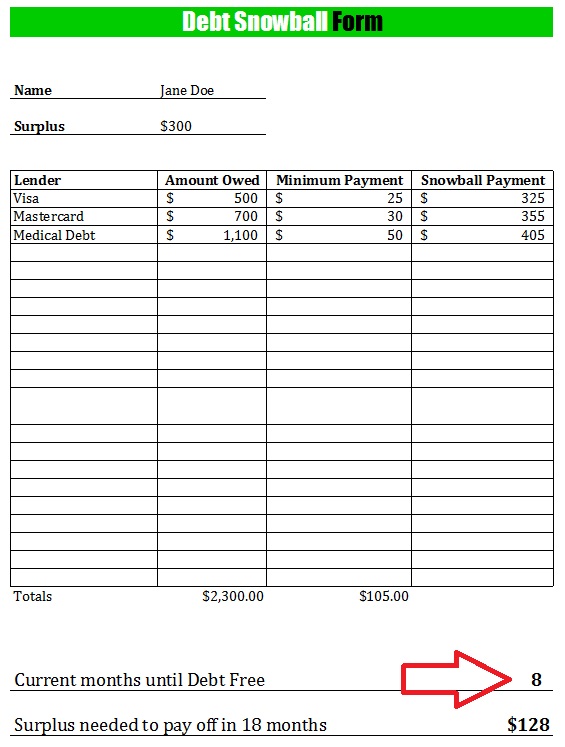

debt worksheet printable

debt worksheet Yelom.agdiffusion.com