Free Printable Debt Snowball Worksheet and Things to Understand Inside It

Having a strategy of calculating the debt is important. Yes, the strategy will be useful, especially for those who want to have good management in financial field. In this occasion, we will talk about the free printable debt snowball worksheet as one of the strategies to apply.

Do you ever hear about the debt snowball before? Well, in this occasion, we will talk about the printable debt snowball worksheet, which maybe could give you inspiration in managing the debt. For those who are curious with this kind of document, please take a sit and read some following writings below.

What is Debt Snowball Worksheet?

Before talking more about the debt snowball, of course it is quite important to know the meaning of debt snowball. Something that you need to know, debt snowball is a method of the strategy of debt reduction.

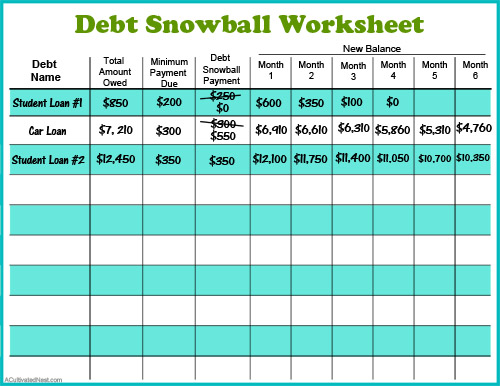

Here, the strategy is applied by listing the debt of yours from the smallest to the biggest amount. After finishing making the list of all debts, you could pay the smallest debt and then make the next strategy to pay the bigger one.

Pros of Debt Snowball Worksheet

Before applying the debt snowball as the management strategy of debt, knowing the pros of it is important. This matter could be the reason why this strategy could be applied well.

Some pros of the debt snowball to consider as reason of applying it are:

- Good psychological effect of achieving the small step of clearing debts. When the small debts could be handled well, the bigger debt will be easier to be managed.

- The debt snowball is simple. The simplicity becomes the pros of this document. It is reasonable because here, you do not need to calculate the interest rate of the debt

Cons of Debt Snowball Worksheet

In order to make the balance consideration, knowing the cons of printable debt snowball worksheet is also important. This knowledge also could be the consideration before you apply this method to manage the debt.

Some cons of the debt snowball are:

- The biggest debt needs more money, especially when there is interest there. It means that pending the payment will increase the amount of the interest

- Do not focus with the paying time. Yes, the focus of this debt snowball is the amount of the debt. However, something that you need to know, the debt has deadline of payment that should be thought too

Considering the pros and cons of the debt snowball is important in order to know well about this method of managing the debts. Of course, the debt snowball could be the ways to be more discipline in paying the debt. However, you still need to be selective, especially thinking about the cons.

That is all that you need to know about the debt snowball. It is good for you to do some researches in order to find the sample of free printable debt snowball worksheet. By knowing the sample of it, making this document will be easier and you could manage the debts well!

free printable debt snowball worksheet could be a good document to manage the debt. By this document, managing debts and its payment strategy will be easier.

As soon as you are out of debt, you will be in a position to invest more money in investments, vacations and much more. It is easy to fall into debt, but it is not very easy to stumble. Once the debt has been paid, after that, you can apply your minimum payments for the first and second debt, in addition to the extra to your third debt, etc. Often, you can pay off your smallest debt in just a month or two.

Read Less If you are struggling to pay off your debts, it can be difficult to understand where to start. Whichever method you choose to use, the payment of your debt is sure to leave you with more peace of mind and money to spend on what you want. Pay the minimum payment and the amount in excess for the smallest debt until it is paid.

At this time, you will have everything you need to face your debt. Calculate how much you can afford Calculate how much you can pay to cover each debt at the end of each month. Finally, find out how much money is ready to pay off your debt monthly. The more you can pay your debts monthly, the faster you will be able to pay them all. Decide how much you will pay monthly for your debt. You start paying the maximum interest rate debt first.

When it comes to paying the debt, you may have heard thousands of tips. If a promotional interest rate ends, you may have to reorder your debts to continue focusing on the maximum rate. In general, people who are indebted with several credit or charge accounts use the following strategy. When it comes to paying off debt, the first step is to produce a budget and prioritize your payment schedule. Woroch says that now that he is trying to pay off his debts, he should grow to become a priority. At the time he reaches the highest debt, he has released all the money he was requesting for the most compact amounts.

Ultimately, the method you choose to deal with your debt is not as important as paying for it. Next, you must know the precise amount of each of your debts and your interest rates and minimum payments. Although it may seem daunting, it is important to understand the full amount of debt you owe. Paying off debt is one of the biggest behavioral changes that could help achieve financial independence. Determine how much you can spend on your debts above and beyond the minimum monthly payment. When your first debt is fully paid, the rest of your snowball will be applied later to the NEXT debt, etc., until all the debts are paid. As soon as you pay your first debt, make the payment with that debt to the next, do not save the savings.

After you have finished your snowball debt, you will discover a lot of extra money each month! The debt avalanche procedure is very much like the snowball debt. The faster you approach your snowball, the more likely it is that you will finally escape from debt! ”

free printable debt snowball worksheet

Free Printable Debt Snowball Worksheet Pay Down Your Debt!