How to create printable mileage log

Maintaining your automobile or your truck becomes something important. When you have a car and it has through the long journey for the business, your car may become cheaper than the car with lower mileage. Counting the mileage is something that will help you to record and maintaining the car condition. You do not need to make your own mileage log because you can download printable mileage log easily.

People who consider about mileage will try to record the mileage of the business trip start from the business location to the destination until back from the destination. There will no body that want to buy your truck or your car if the automobile has pass the normal mileage.

But if your car still in the less mileage, you can bring it to the service center and then you can make some reparation before you try to offer it to the possible buyer.

Tips about the printable mileage log

People that maintaining the mileage of the car will not only know about the long journey but you also can avoid the audit. You also can count the gas necessary everyday base on the mileage in each day.

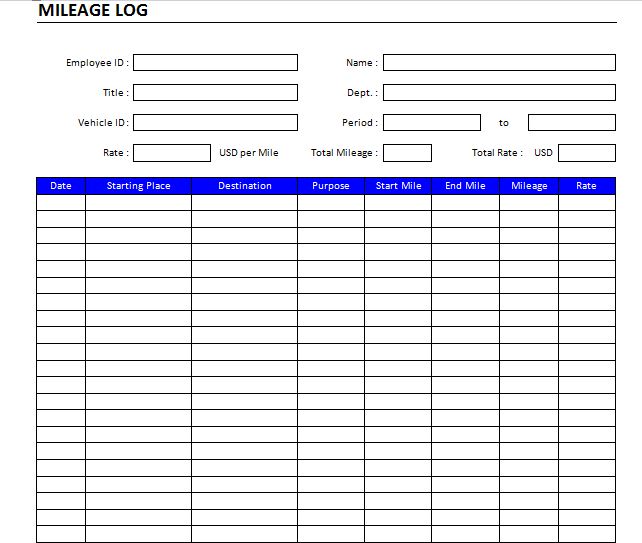

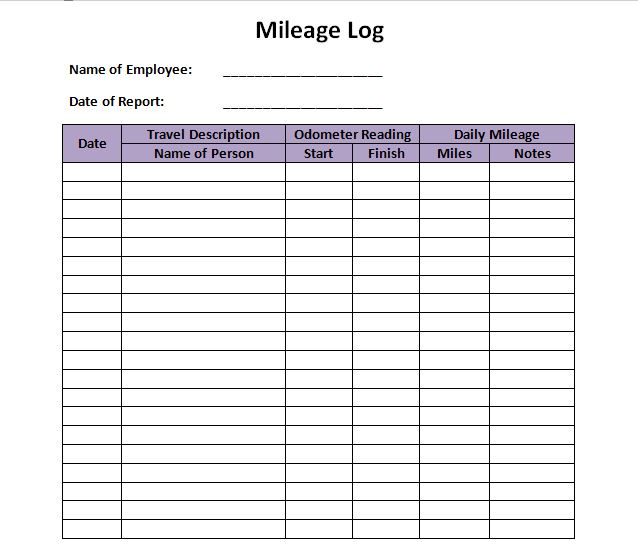

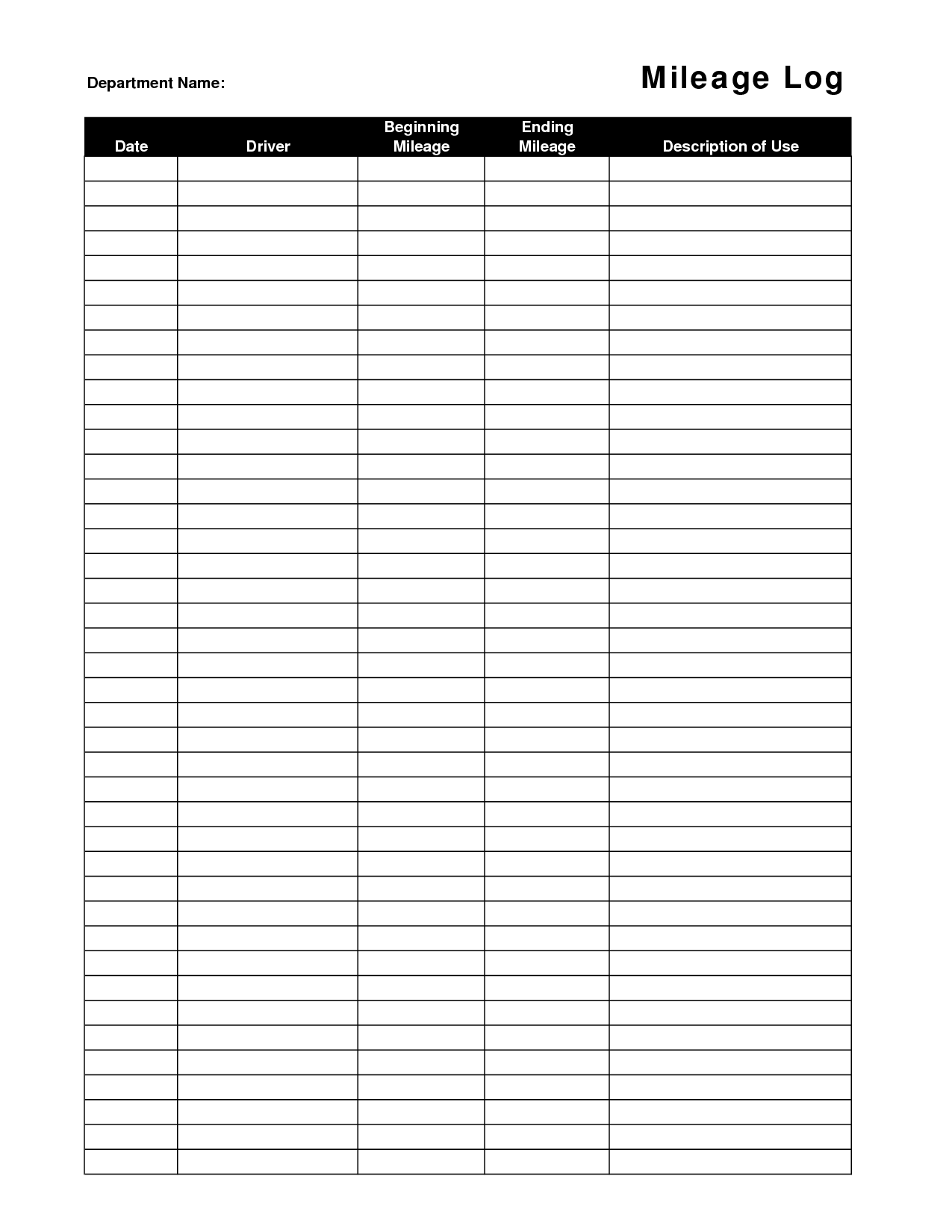

The good printable mileage log usually contains with the list but there is also other information that will help you to make deduction. From here, you can see the sample of template and you can choose the best template base on your necessary. If you like to get more information about the travel tips, you only need to open the articles are provided.

Print more than one sheet

If you have a large number for business trip, you should prepare more than one sheet. It is good for you if you have the mileage log in the book shape. You can write the mileage after you back from your trip. Don’t forget to mention the date and the time. It will make you easy to maintain your car and manage your trip.

The printable mileage log is easy to use and the template is editable. If you need to change the content or revise some part of the sheet, you can use the software from your computer. People usually use Microsoft excel to edit this template.

The normal mileage rate is determined by the IRS. You should know the normal mileage rate because it will help you to keep your automobile or truck stay in the normal mileage. If there is something wrong or failure, it is because of your mistake. You should consider about the condition of your car and don’t for get to write the mileage log.

More benefit

Having the printable mileage log also gives you more benefit. It will not only make you know the mileage of the car trip but you also can manage your money. If you earn the money from your trip you can write it on the mileage log.

Now, don’t be doubt to download the mileage log because it is become something useful especially for you who have the long journey with the automobile or truck. You can sell your car before it is pass the normal mileage because it will allow you to get more money than you sell the after it is pass the IRS normal mileage.

printable mileage log is something useful especially for you who like to make long trip with the car. It will help you to control the mileage and deducting the mileage easier.

The other method to deduct the mileage is through a proportion of the actual expenses of the commercial use of the automobile or truck. Since it is 50 A per mile in 2011, it will be your biggest expense at the end of the year. You must record mileage for business trips from your business location to your business destination and back to your business. Nobody would buy a car that does not offer a good or systematically superior mileage. If you have a car, be sure to confirm the mileage in a normal time interval. If your car or truck gives you less mileage, then stop by the service center to create the desired changes. Also, if you have decided that you need new tires, pay the excess money for the stems of the metal valves.

Maintaining a proper mileage record sheet can be the source of an extremely excellent deduction for your small business or the reimbursement of your miles for work. You must track the miles to avoid a possible audit. You may believe that you travel more miles in a shorter period of time and, therefore, use less gas, but it does not work that way, just because of the air resistance.

The list goes on and on. Confirm that the mileage record includes the information necessary to obtain a deduction. If you want more information about travel tips, feel free to go to. After that, you have to run to track all the information that should have been tracked all the time. There is also information on articles that EE. UU It prohibits them from being imported. The manual entry of travel data into a record book is tedious, especially in the case of a large number of business trips.

If you are audited and can not offer a mileage record, you will reject the deductions. Now that you have organized your physical files, it is time to establish a record keeping system that you will maintain normally. Choose the format you want. The simple spreadsheets that you can set up with software such as Microsoft Excel can help you keep up with everything.

One could be the normal mileage rate, which is determined by the IRS. One more thing is that the growth or failure of your company depends entirely on you. The third factor of mileage of the tire is the amount of the tread of the tire.

The fact that your store is created on paper does not negate your responsibility to file taxes! Most likely you will discover that, from the owner of a company, there is legislation that requires you to continue to keep records of your company over a period of many decades. You are an Independent Business Owner and, as such, you are expected to act as if you obtain a normal store made of brick and wood. Therefore, you must have some way to track your business or kilometers of work to strengthen your claim.

If you have struggled to make a precise budget for your home, it may be due to the simple fact that your estimates of expenses may differ from reality. There are many methods to earn money from home using Microsoft Excel. With the actual expense method, you totalize each of the expenses for using the car and the multiples for the proportion of use in the organization. If you want to know more about the subject of vehicle expenses or mileage records, please contact us. If you are earning a large Avon income, then you will have to file and pay an estimated income tax every quarter so that you do not have to pay a large amount of taxes at the end of the yeara and yes, they have Avon representatives who generate income. six figures and have to pay their income taxes quarterly. Whenever you do your taxes, there is also a location where you can connect your 1099 information if you have one. The IRS wants you to keep timely records.

printable mileage log

Printable Mileage Log Sheet Template | office | Pinterest