You still have to budget. Gathering a budget needs a resource to help you organize your finances. Our easy vacation budget was created to help you plan your expenses and stay within budget.

If you have not already done so, following a budget is a fantastic way to protect your finances. Your financial plan will help you prepare a debt management program. Your first budget should be really simple to manage and stay updated to help you control your finances.

You will want to balance your financial plan and make sure that your expenses do not exceed your earnings. While any type of budget will surely help your financial situation, employing an envelope process will surely create your most effective budget. If you are looking for the simplest and best FREE approach to keep a budget and meet it, visit Mint.com.

Be as complete as possible when you create your financial plan. Before you start doing your finances, it is very important to realize this to be successful, you must provide the most detailed and accurate information possible. Your financial plan must change to accommodate them. These steps will allow you to set up your budget and manage your finances by helping you track your income and expenses. Having a work budget in place will allow you to identify precisely where you are with your finances.

To achieve this, you only subtract your expenses from your earnings. By making use of a budget system, you will have the ability to compute your expenses, in addition to reserving a specific percentage of your income in your savings account. At the end of the month, it is possible to evaluate your expenses and review any changes you may make.

Without the simple reading of financial data, there is absolutely no way to know what is happening with your money. Everything you need to manage your money better! As soon as you begin to consider money more frequently, you will discover that you have the ability to find more ways to save and increase your profits. When you do not understand where your hard-earned money is going, it’s simple that the paycheck quickly escapes you. It may be tempting to spend less by booking accommodation beyond the city center, but traveling daily to the city can be very expensive and requires a lot of precious moments of sightseeing. In addition, it helps us determine how much money we have left for the remaining part of the month.

To calculate your monthly expenses, you must start by recording all the money spent in a month. Once you realize where your hard earned money is being spent, you can start working on a strategy to maintain a budget. It is almost always better to have an excessive amount of money at the end of the month that is not enough.

The templates are fully editable, which allows you to customize them based on your income and personal expenses. Please be sure to save the templates. There is a variety of totally free budget templates available to meet your needs, while it is for college students, parents with children in day care, single-income homes, etc.

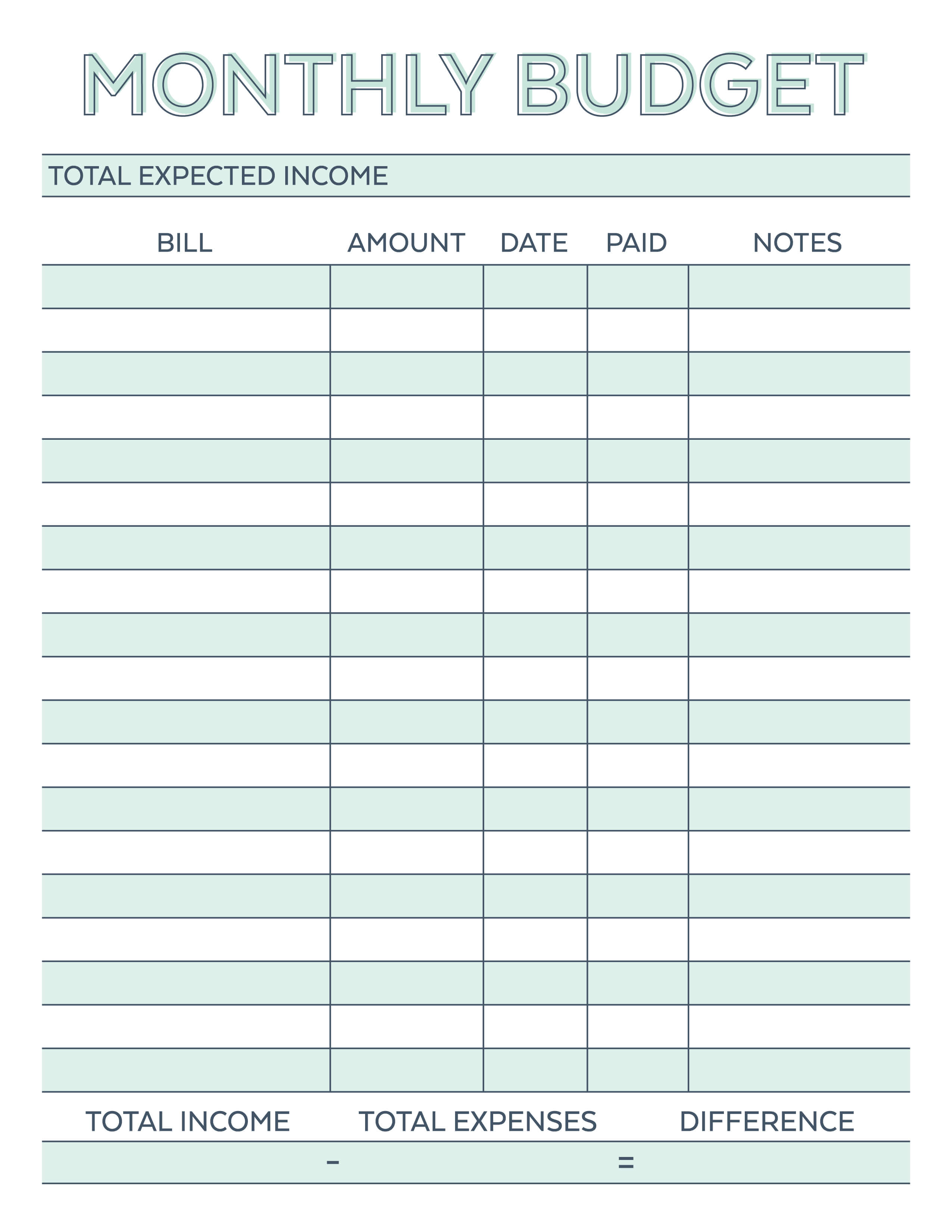

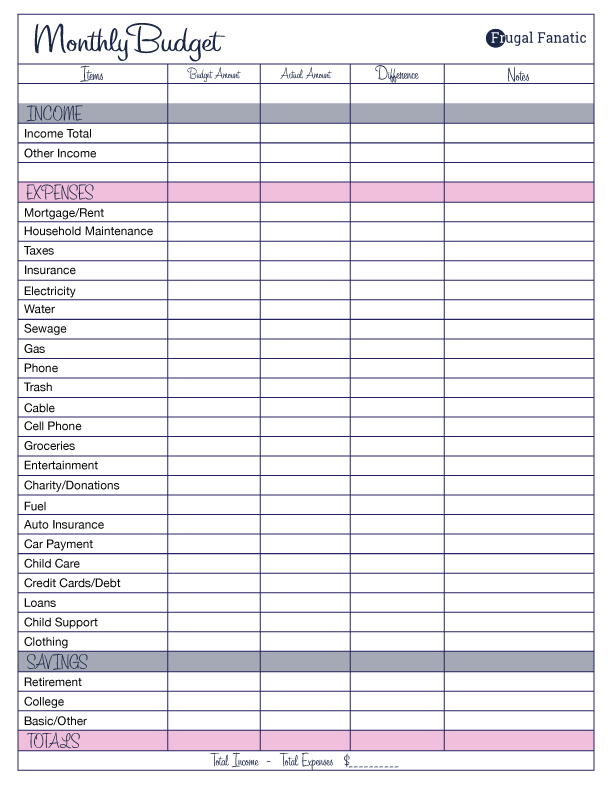

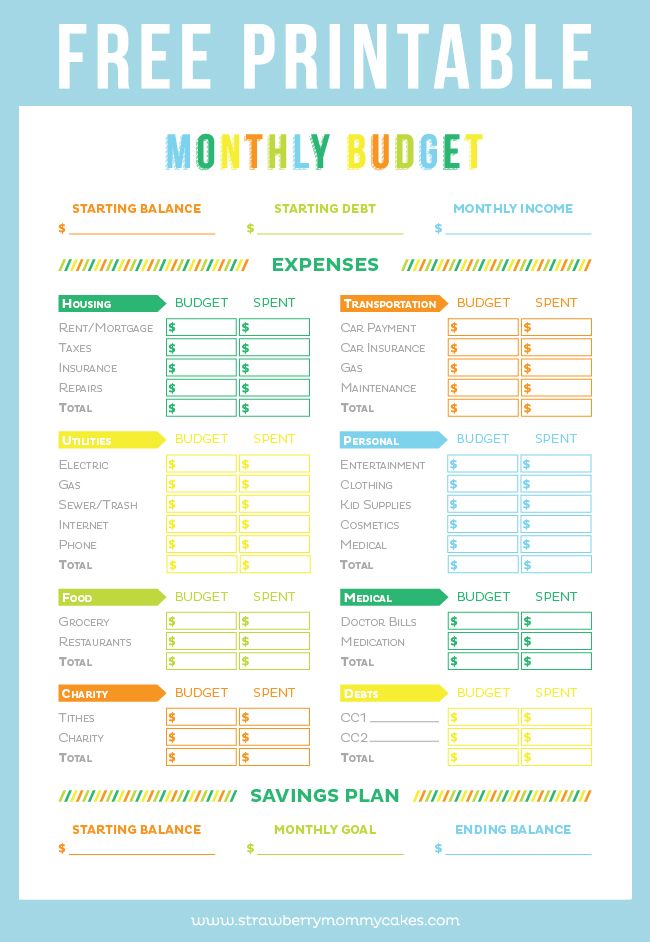

budget printable

Free Printable Monthly Budget Planner Worksheet