There are several types of weekly organizers that could simplify family life. It’s so easy that you can set up your annual bill organizer in a quarter of an hour. Being an organizer of the household bill is likely to make your life not so stressful. The organizer of the shopping list guarantees that each of the items is there and then offers an estimated price.

Access to materials is not a problem. Once you scan, the information is just a click away. More information on emergency preparedness, including how to put together a family communication program, is available at www.Ready.gov.

No matter what kind of application you are looking for, however, there are always enough available. If you are looking for an easy and charming application that helps you keep track of the lists of normal tasks, Todoist is your new obsession. Some applications can call for purchases within the application. While an audio application may not yell at small businesses, do not forget that creating an engaging store experience is critical to customer satisfaction. During the design procedure of the payment invoice template, it is necessary to think about the payment invoice template applications in many places.

Continue until you have completed the year. If you wish, you can continue dragging the following year, too. By keeping track of exactly how much you save each month, you will have a better perspective of creating progress towards your goal. When it is organized, you will find that paying your bills each month is no longer the dreaded task that you have been previously. Remember that you can only do a lot every day.

Most people understand how to make money, but they do not understand how to save or spend money. They think that the transmission does not generate money, but once you start accumulating the flows, you can earn a decent amount. Saving money is a natural thing for some people, but nevertheless, it can be a little harder for others. If you do not understand where your hard earned money is going, it can be difficult to make the necessary changes to change your financial habits. You may not only start saving more income, but also pay off your debts. You will have the ability to do what you want and earn some additional money. Subtract your monthly finances from your monthly income so you understand how much money you have to spend monthly.

Finding a loan is not free, regardless of the type of credit you request. On the other hand, if you submit a mortgage application with a minimum debt, your probability of obtaining approval is higher. Instead of waiting until you need cash and are about to throw coins to buy gas, you must prepare in advance.

Consider what bills you must pay, how much they are and when they are due. At the end of the month, simply add all your bills to find the total for the month, so you can make a budget later. If you feel comfortable paying bills online, do it. Paying bills on time and avoiding late fees is simply a method to keep more cash in your pocket.

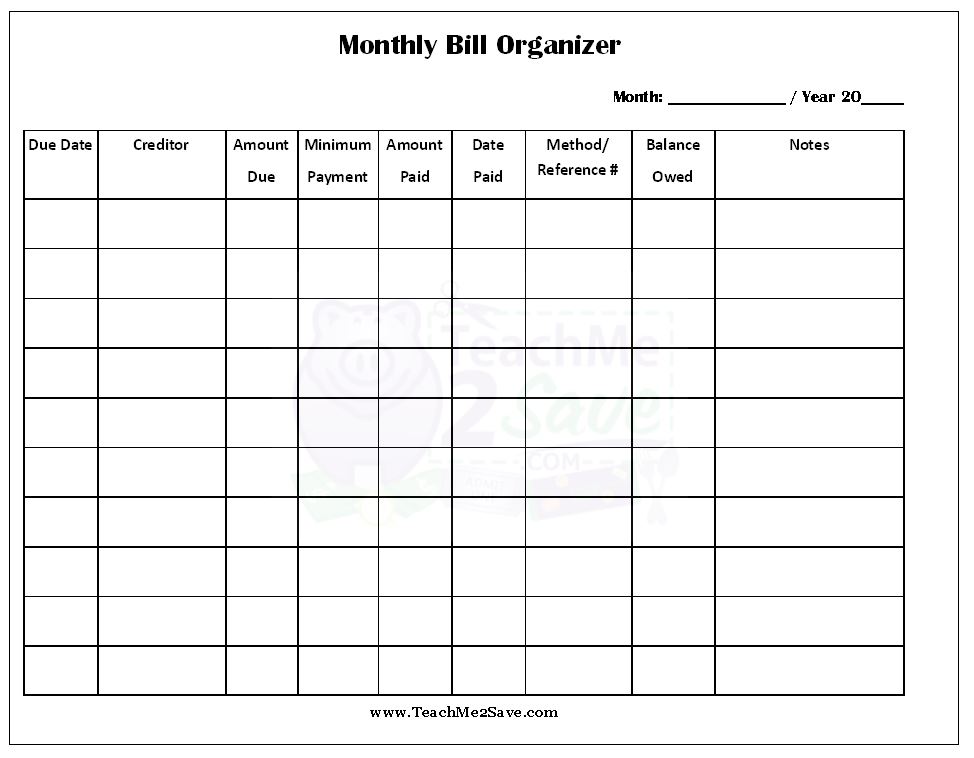

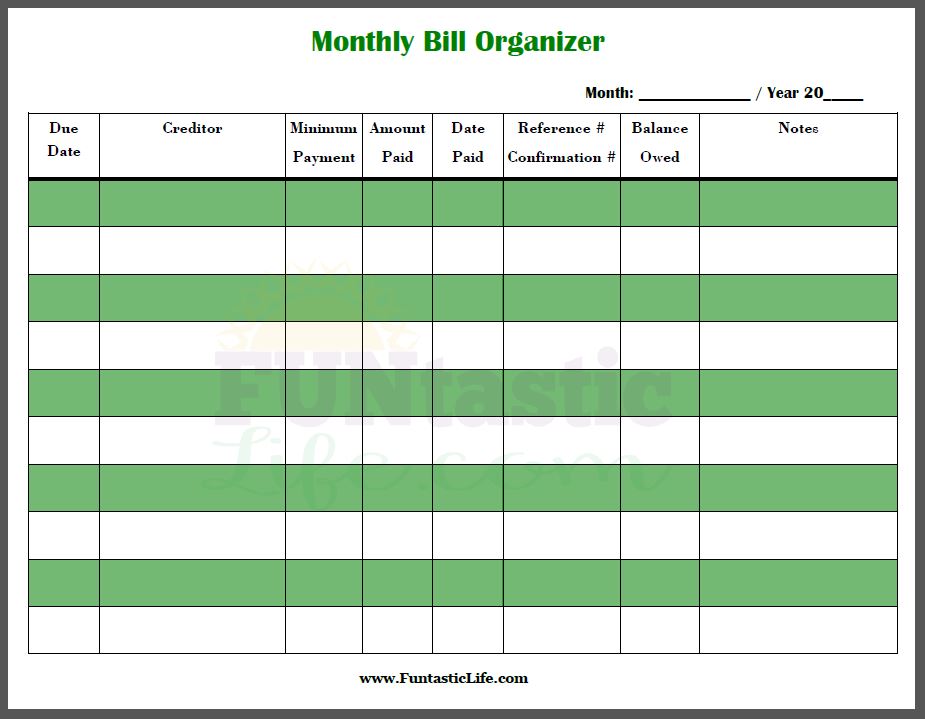

create a printable monthly bill organizer

printable spreadsheet for bills zrom.tk