The Debt Snowball Worksheet Printable Templates

A debt snowball worksheet printable can be used to prevent your debt from getting even worse from time to time. It is understandable that everyone has problems with debt, especially debt that has high interest and getting bigger and bigger overtime, hence the term “snowball”. The worksheet will help you to determine everything related to the debts and get rid of it eventually. Here is more information about it for you to read.

The Key Elements on Debt Snowball Worksheet

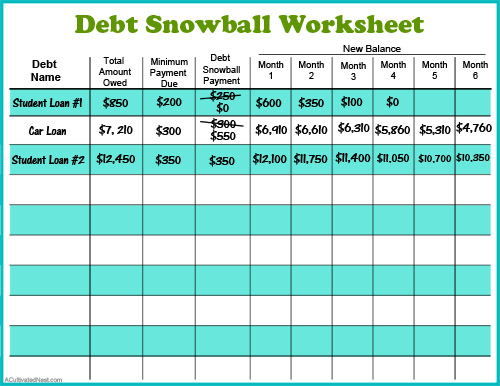

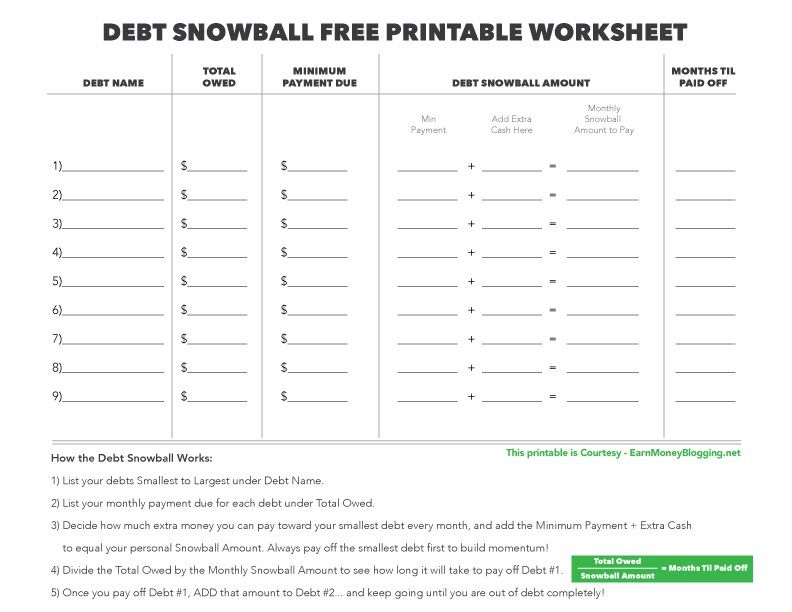

What should be written on debt snowball worksheet printable? There are a few mandatory elements for you to pen down when trying to figure out the debts on the sheet. The two most important key elements of the sheet are going to be displayed down below. Make sure you have them on the sheet and write them down very clearly.

- Name of the Creditors/ Debt Name

When you have multiple debts, you will get confused of your own creditors. It can be hard to determine how much money you owe and how many months left for the debt to get paid off. That is why the very first thing that you have to write on the sheet is the name of the creditors. Make sure you know exactly the source of money you get from.

- Monthly Owed

Without understanding how many months left for the debt to get paid off, you will find it hard to gradually paying for the debt. On the sheet, the due date for the debt to get paid off will be written very clearly so that the person in debt will have a good understanding about how much longer they should pay for the debt.

Example of Debt Snowball Worksheet

- Credit Card Debt Snowball Worksheet

Most people have credit card debt. When the credit card debt is not paid off, there will be higher interest. You may have some problems with creditors, too, when this type of debt is not paid. To take care of credit card debt, you can get the debt snowball worksheet printable here. It will help you manage the debt and make sure you won’t be late to make payment.

- Mortgage Debt Snowball Worksheet

Besides credit card, people often have debts for their house, too. It is quite impossible these days to buy a house right away and paying off it cash. Most people are using mortgage to buy a house and of course it is included as debt. Manage the mortgage loan you have with the worksheet right here.

- Personal Debt Snowball Worksheet

Even when the person loans you the money is someone close, such as relatives or good friends, it still means that you have to pay the money back at some points. Use this personal debt snowball worksheet to make sure you won’t forget those personal debts.

The worksheets above are truly helpful in managing debts. Make sure you know exactly not to let the debt goes worse and worse to eventually give you a legal problem. Use the worksheet to figure everything else. Once you have a debt that you may have forgotten very soon, download the debt snowball worksheet printable right away and start taking care of it.

Once you are out of debt and must continue living as before, the savings you make can go a long way in healing your wounds. The earlier you pay off your debt, the more money you can save and save money creates a lifetime of possibilities. If you are ever likely to escape from debt, you have to deal with the payment as a non-negotiable monthly obligation. Whichever method you choose to use, the payment of your debt is sure to leave you with more peace of mind and money to spend on what you want. Not all debts are the same. Carrying a high-interest consumer debt is just one of the biggest barriers for people trying to cultivate their wealth and achieve financial freedom.

The amount you must invest is based on the total amount of debt owed and the interest prices. The way in which debt can pay off debts is possibly the most fundamental and crucial step in a person’s pursuit of financial peace. Therefore, you should never get into debt, and even when you do, you should be intentional in paying the debt whenever possible. When you begin to eliminate the easier debts, you will begin to observe the results and start earning in debt reduction.

Maybe he would like to escape from debt. After determining how much you can contribute to your debts, you should find out how much your payment should be in each account. Having a single credit card is easier to manage, which usually means you are less inclined to accumulate debt. Mortgages are mortgages and it is very likely that you can tackle one, so find out what is the best way to incorporate it into your general personal financial system.

You do not need to be anxious to find the amount to pay your debt. Simply from the point of view that you know how to get more income with the money you currently have. Along with 401K and HSA, a person can also contribute tax-free money to a flexible account that can be used for medical expenses along with the payment of child care expenses. Once the card is returned, you visit the next card with the smallest balance and do exactly the same until you pay off all your debts. If you have more than 1 credit card, you may want to examine the bills, see what your balances are and which have the maximum interest rate. Eliminate the idea that you need several charge cards.

If you are dedicated, you could even earn money by exercising. There are many approaches to earn more money in the modern shared economy. Now you can use the extra money in savings or other expenses that were not part of your budget as soon as your income was lower.

In prayer, it is lower than your earnings. You should also be thinking about increasing your profits. Revenue is easily the most important facet of any financial planning. Although having an excellent income is essential, it is just as important to continue controlling your savings. Equity is another type of construction wealth.

debt snowball worksheet printable

Free Printable Debt Snowball Worksheet Pay Down Your Debt!