In any case, a mileage record is the best way to ensure that your deduction will be kept under an audit. Your mileage record and mileage records can generate significant savings throughout the mileage deduction. You must include the initial mileage on your vehicle’s odometer at the beginning of the year and your final mileage at the end of the year. You’ll need to keep a record of contemporary mileage.

If you intend to select the mileage deduction, you do not need to keep a gasoline registration book. The normal mileage deduction may be easier to control, but overhead costs may be lower than actual costs, especially if the car does not use fuel. You can use the standard mileage deduction or the actual expenses of the car.

Keep in mind that you will still have to track your mileage for the actual spending process. When it comes to mileage, many people make the mistake of documenting very few details. Mileage is one of the largest expenses that the real estate community can make the most of each year. The simplest method is to take into account the mileage at the beginning of the year.

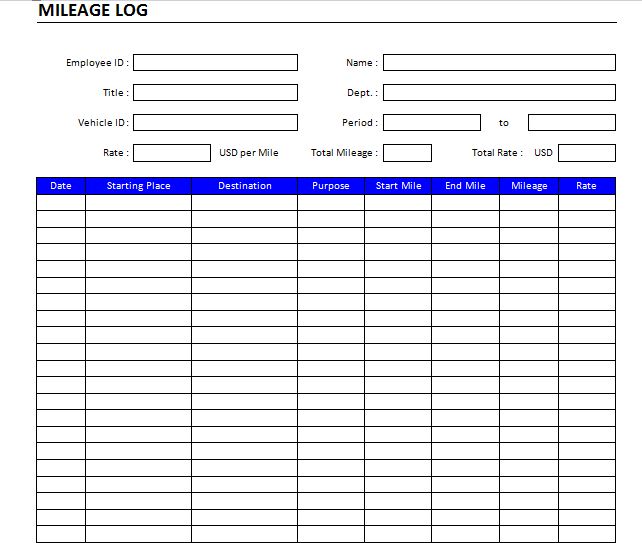

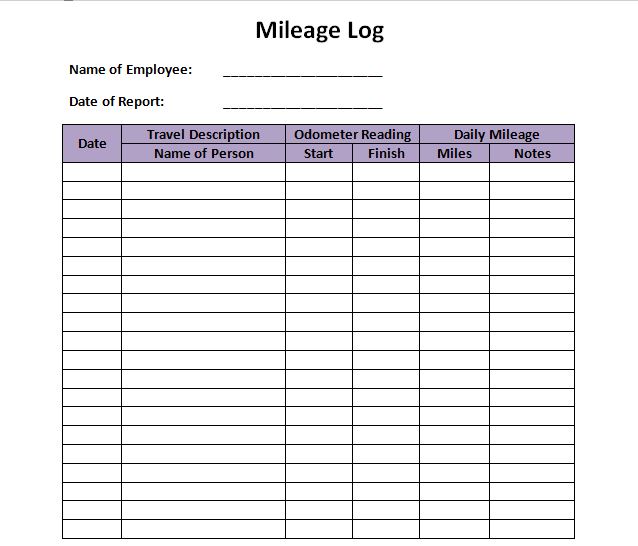

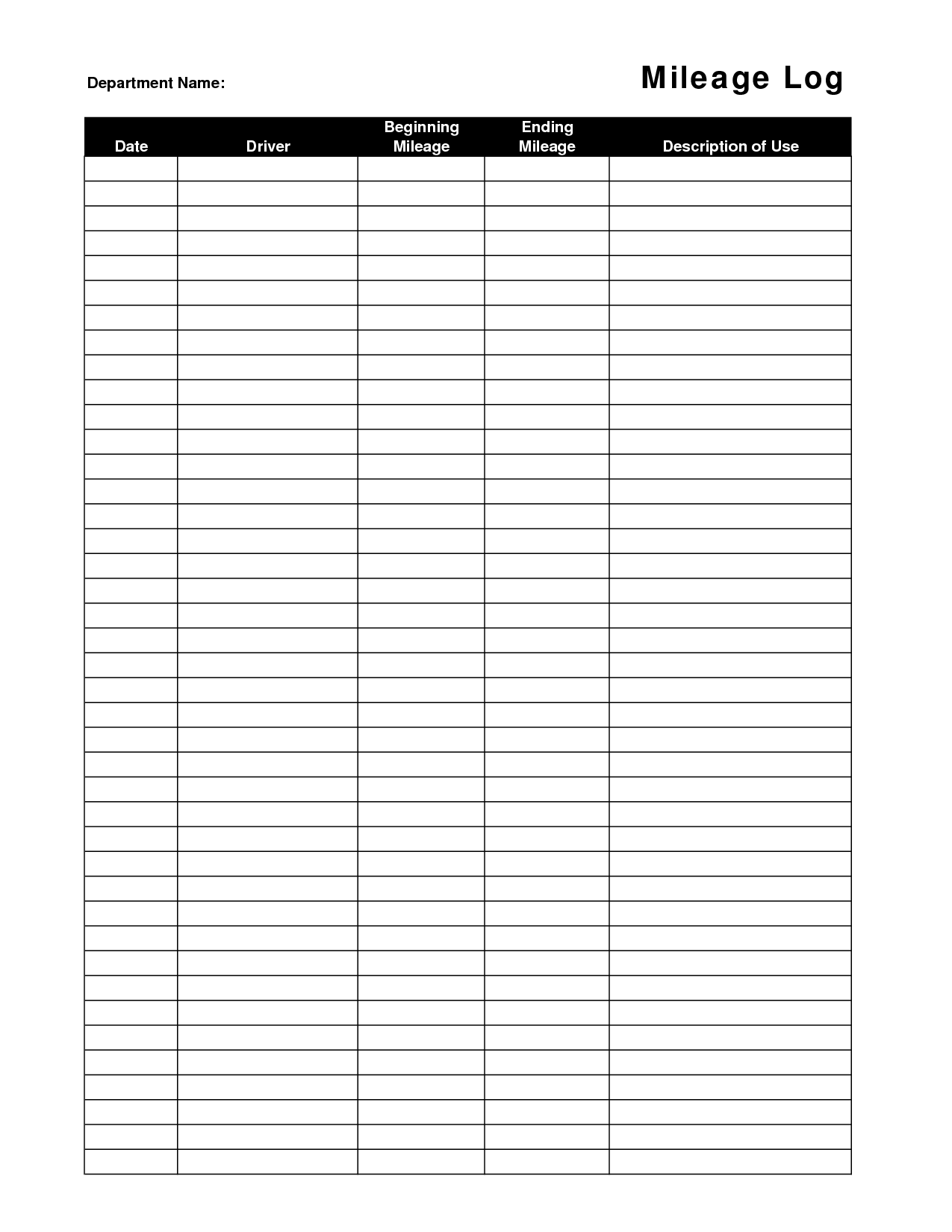

You can continue to maintain your record in a conventional manner by working with a mileage record book. The key point to remember about mileage records is that if it does not directly benefit the company, it will not be counted. They are an essential part of any A, as they not only allow companies to keep track of mileage information based on their employees’ work that can be used for travel reimbursement, but can also be used to tax return purposes. They make large deductions, so when the IRS shows an example of a mileage log, they want to make as much trouble as possible! Keeping an accurate record of miles may seem like a laborious task, but the amount of deduction or tax payment you will receive is a good reason to continue doing so.

Decide how you will record your mileage. Nor are you allowed to simply estimate your mileage, or return and create your records as you already face the audit. The other means to deduct the mileage is through a proportion of the actual expenses of the commercial use of the automobile. “It’s becoming a major problem,” he said. Claiming the mileage of the business helps reduce the benefits of your business and, therefore, the amount of taxes you pay at the end of the year. You will have to record mileage for business trips from your small business location to your small business destination and back to your company.

If you do not have a mileage record, you are in danger of losing more than just vehicle deductions. A mileage record denotes the document you use to control the miles you have traveled. While you will not have to submit a full mileage record when claiming the deduction, it is important to obtain diligent records.

If you choose to keep a handwritten record, it must be legible by anyone, not just the man who makes the mileage record. During the time that you are allowed to maintain a handwritten record, you are vulnerable to human errors, including omitting the name of the client or the destination address. You can also see the reading log for children examples.

free printable mileage log

30 Printable Mileage Log Templates (Free) Template Lab