Tips for monthly bill tracker printable

Very ones have their own necessary or bill. You also must be like that. There are so many things that need to be paid. If you do not make good planning for your money, you may be shocked because you spend so much money but you do not know detail of the bill. By using monthly bill tracker printable, you can manage your money easier.

![]()

Benefit for using monthly bill tracker printable

Actually now you can use modern apps for the bill tracker but manual bill tracker still needed. You should use both of these trackers if you want to keep you budget goals. The apps can be used to demonstrate your budget goal and the traditional monthly bill tracker printable will help you to remind and manage your budget more effectively.

![]()

If you do not manage your budget for the bill, you money may spend up without any goal. You should make your money become more useful. The good money management not only makes you feel easy and smarter in paying for the bill. But it can attract the investor or someone to be your partner.

![]()

If you do not serious in managing your money and bill, you cannot save you money for other important budget goal. Sometimes you need to buy a car, go for travelling, and make a new business or many more.

![]()

You can write your budget target or planning in a sheet of paper and make it in a list. When you see the list, you will remember to safe more money to realize it.

If you work so hard to earn the money but you spent it without good management, you still get bankrupt. You need to avoid this condition by using the monthly bill tracker printable. You should not be worried again about your budget or money because you can manage it easily.

![]()

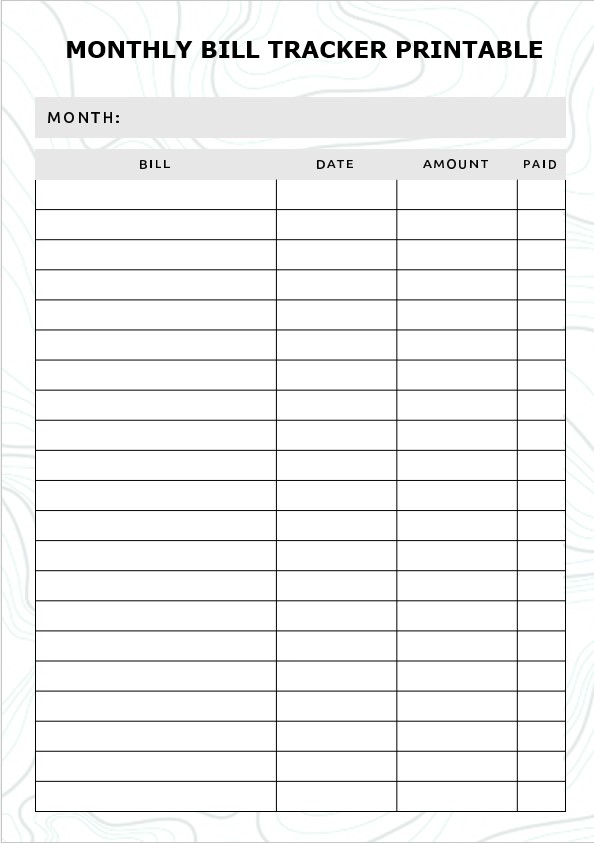

To get the bill tracker, you do not need to make your own because you only need to download the bill tracker freely here. There are some of printable bill trackers that you can find. You can try to find the best bill tracker that appropriate with your necessary.

![]()

After you get your best printable bill tracker you can print it. And then you should look to the content for the sheet. After that you only need to write your monthly bill on the paper. Bu using this printable monthly bill tracker, you will know how much you should spend your money. You need to take a point for the savings.

![]()

The savings can be used for the accidentally necessary or for your dream target. Without save your money, you will have no money if you want to go for traveling or something unpredictable.

Now, it is the time for you to repair your money management. Make your best plan with the monthly bill tracker printable. You can control your bill payment because you know what that become the priority. Your money is only a tool but if you do not smart in using this tool, you will lose it easily.

![]()

Monthly bill tracker printable will help you to manage your bill payment easier. You can take his bill tracker freely base on your necessary.

![]()

If you want to stick to a Budget and achieve your financial goals and stay out of debt, then you want to be disciplined. The organization of a budget requires a lot of time and, in the long term, it is not such an easy effort for most of us. You will look forward. It is also useful after the budget is drawn up, as it can help demonstrate if you are keeping up with your budget goals. A personal budget will also enable it once you request an increase or seek to earn more money in your career. Create an easy budget that you can really stick to.

You will undoubtedly need an appropriate business plan if you want your potential investors to take it seriously! You must stay motivated and focused on the long-term plan. To understand how much you earn, spend and save, it is essential to maintain a personal budget plan in which you can reflect all your planned and actual transactions.

It is possible to save a large amount of money in Managers Specials. You simply have to understand where your hard earned money is being spent. Value enough for you to be anxious to spend money to get it. Whether you want to save money for a great trip or your retirement, you can calculate what you have to save and how long it will take you. Keep in mind that, in case you have a lot of money but you are depressed and have no sense of purpose, you are still bankrupt. You may be very surprised at how much money you are actually spending on specific things that you might have thought was a trivial amount that turned out to be quite extensive.

By planning how much you should spend on each of your expenses, you can help cut back on expenses. As long as your monthly overhead does not exceed your financial plan. You must make sure that you can cover your housing costs, utilities, food, insurance bills at the time you arrive, car maintenance, etc.

The software of the computer has a very simple user interface and it is not difficult to create invoices. It is designed to offer the best possible user experience. In addition, it supports multiple users. The free personal budgeting software offers a monthly budget calculator that helps you receive an understanding of your own personal finances at the end of each month. In addition to the advantages mentioned above, it is available in laptops, tablets and smartphones.

If you are looking for an easy and surprising application that helps you keep track of the lists of normal tasks, Todoist is your new obsession. In addition, the application is easy to navigate, configure and completely intuitive. Anyway, the completely free budget application can be used not only on your laptop but also on a phone or tablet.

You can save even more by using coupons when you get a product at the lowest price. Now there are numerous applications for smartphones absolutely free that you can download coupons directly to your cell phone. Next, you should look for the coupons that match them. Simply write the name of the item you are interested in and the term coupon.