An expense report usually includes these items below. Summarizes and presents all the accounting details consumed by employees of a company in a specific period of time. The car expense report is an excellent tool to save time that will allow you to have a written record of your company’s trips.

You definitely need a plan to keep track of your expenses and your expense file, since it is one of the best strategies to keep track of your expenses. The plan must be constructed so that all the money that enters the provider flows through the correct channels. The corporate financial plan takes into consideration the financing requirements, the inventory requirements and the payment management of a company.

If you are still not convinced, take a look at the reasons for maintaining an expense report form. Because each of these expense report forms has its own special purpose, it is essential that everyone understands how each form should be used. Companies use an expense form to record all expenses they have made, in addition to the particular details of each of these expenses. If you want to use forms such as the Claim Claim Forms to claim the expenses for which you can receive a refund, you must make sure that all the expenses you have made are perfectly in accordance with the reference policies regarding reimbursement.

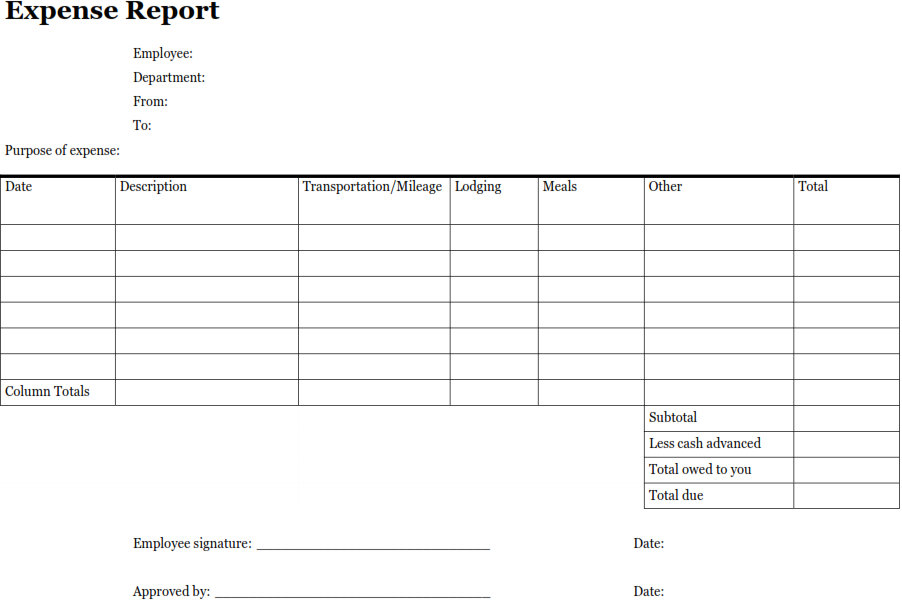

Once an employee enters items in the expense file, he must present and list every detail and every detail so that each expense is calculated and evaluated properly. If you are also employed and would like more information on the subject of expense reports, please read this report carefully. In addition, employees must disclose the receipts of each of them to the Finance Director of the organization before the end of the year. They may appreciate being reimbursed as soon as possible, instead of waiting for the normal paycheck. On the contrary, if you are an organized and parsimonious employee, you will not spend much and save money, earning an excellent reputation among your employers.

When you have finished listing the expenses, you must bring the total amount just by adding the addition formula. Always make sure that, if you are trying to have your expenses reimbursed, the expenses are in line with the commercial policy. The deductible commercial expenses must be separated from the expenses used to calculate the price of the products sold, the capital expenses and the individual expenses.

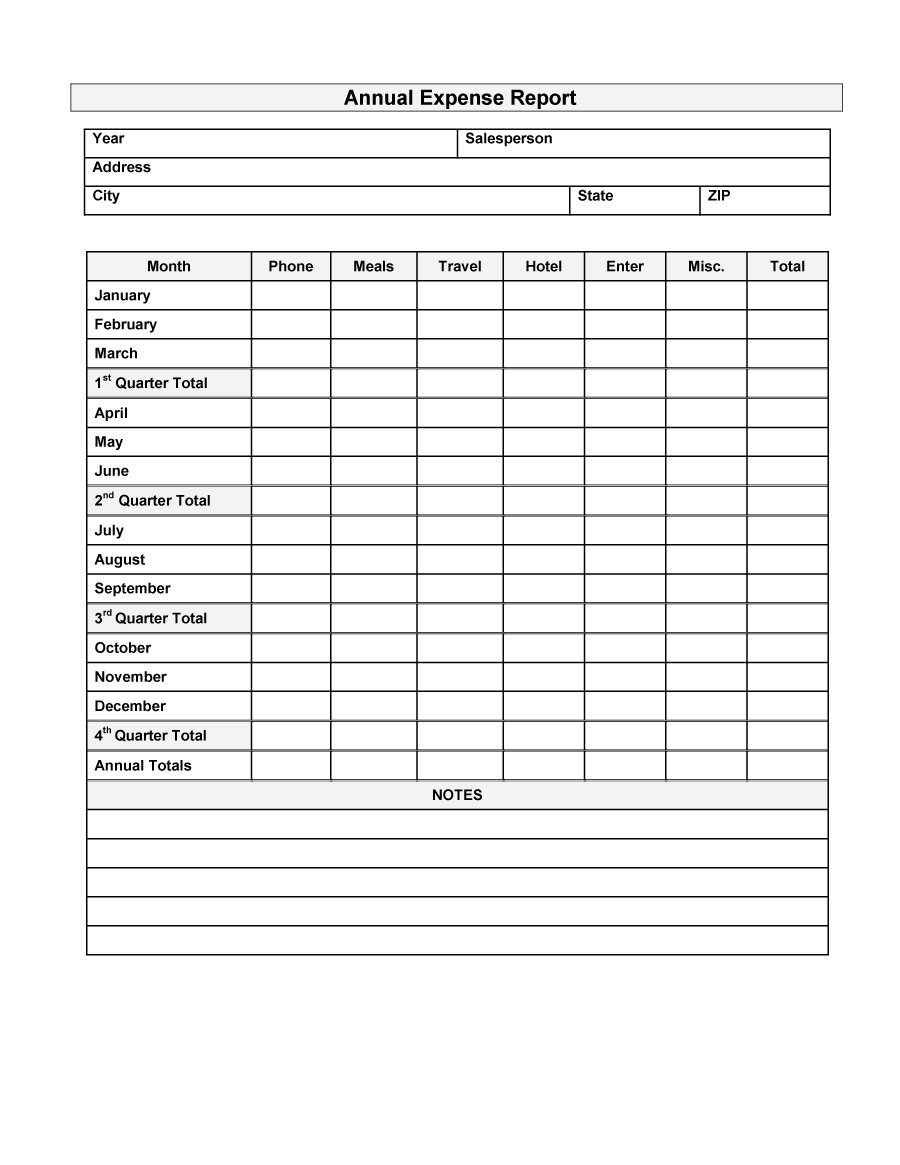

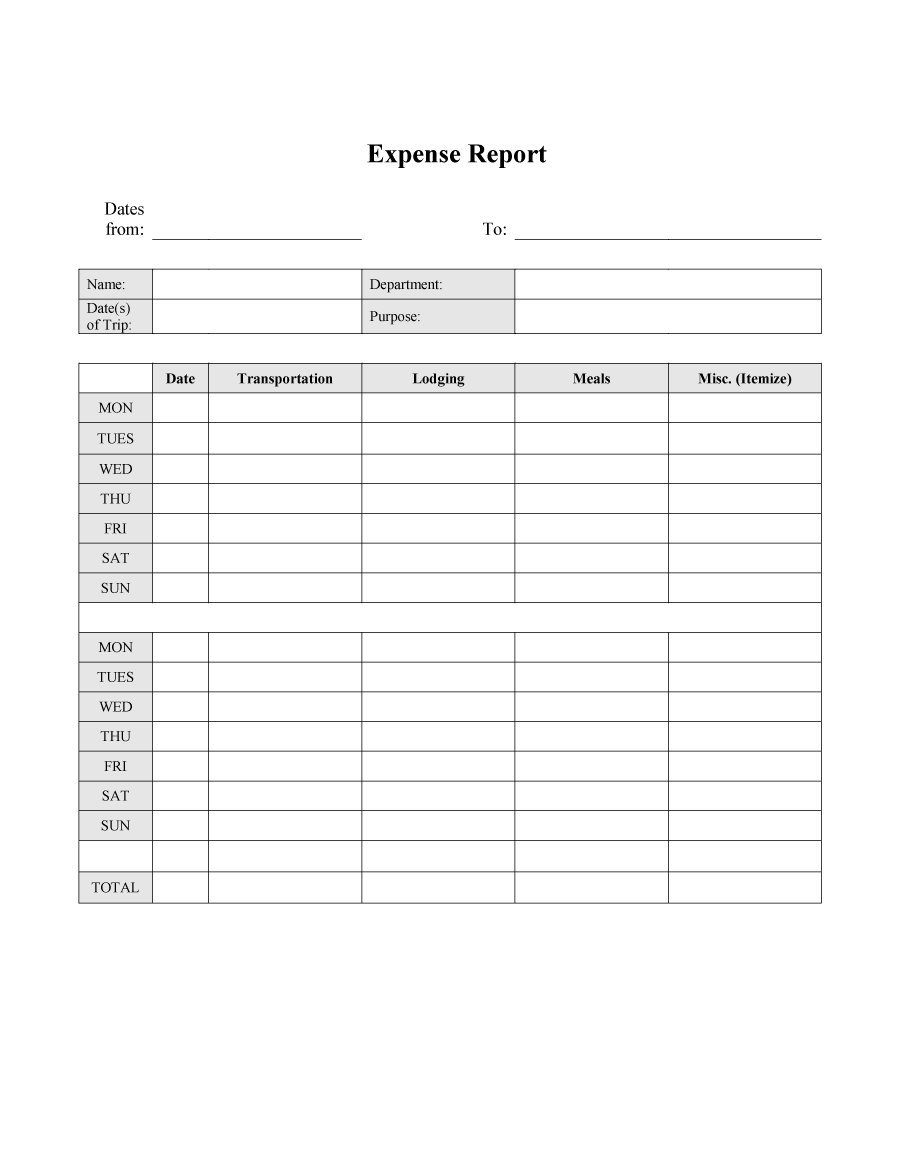

As soon as you have planned to compose your expenses and prioritize them, you must open an Excel spreadsheet. If you have an expense that is divided between personal use and that of the company, you can divide the cost between both and then deduct only the commercial part of the expense. It can be adjusted to include the expenses in which you want to maintain control, and each month is a different sheet, which facilitates the tracking of monthly and annual expenses. Similarly, to help you compose all your expenses, you must follow some basic actions to record all your expenses in Excel. Otherwise, it will only be accepted as a personal expense that the provider is not obliged to cover. In addition, a deductible business expense must be necessary, useful and appropriate to operate your organization.

printable expense report

This printable expense report has spaces in which an employee or