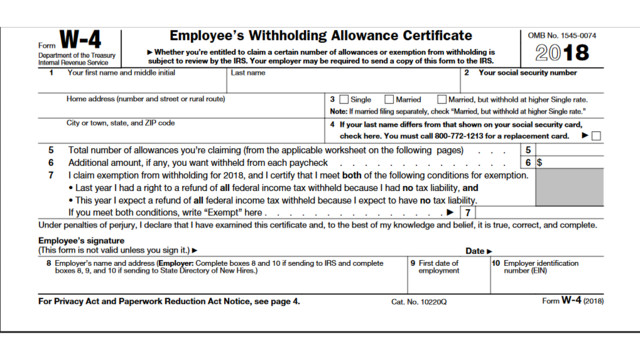

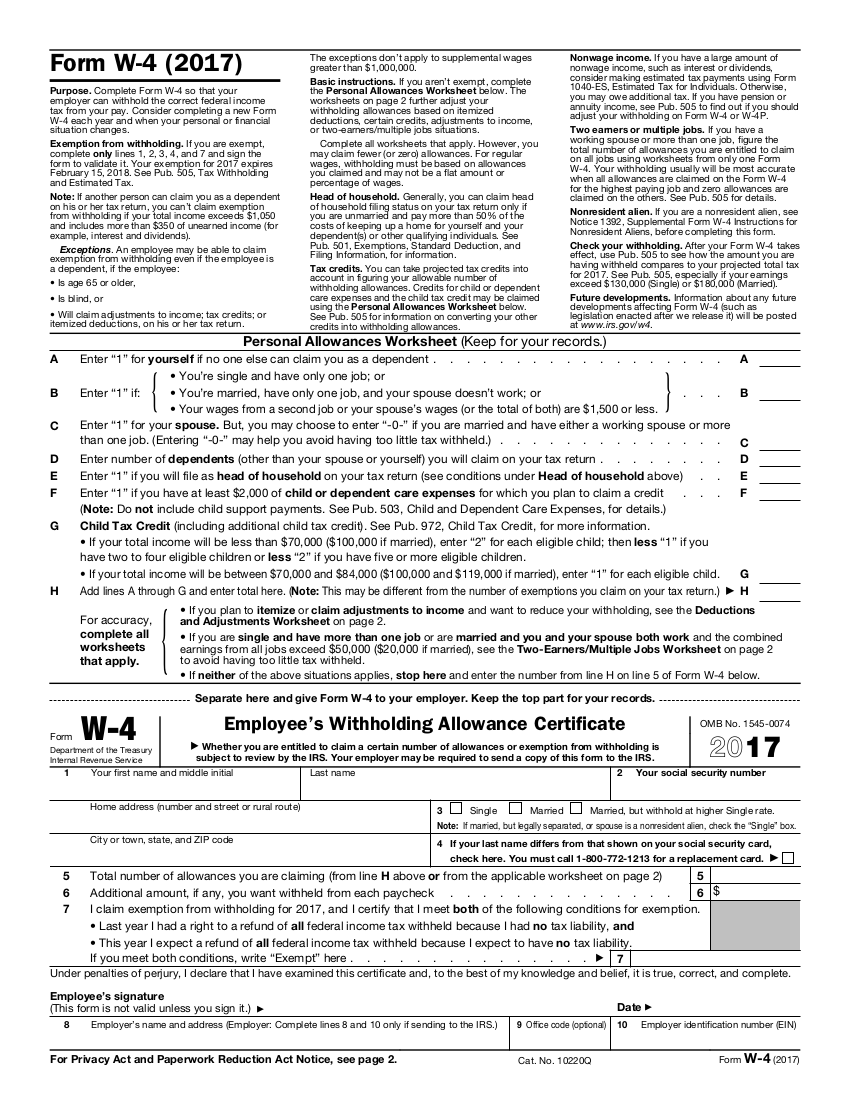

An individual must provide certain personal information and inform general deductions and additional withholding amounts in the authentic form. The withholding tax depends on the individual circumstance of the employee and ideally must be equal to the annual tax owed on Form 1040. The tax must be withheld from the compensation you receive as an employee. Otherwise, you may end up owing additional income taxes at the end of the year. Pay a stand fee if necessary. There is a decrease in the retention rate for people who qualify to see the Married box on line 3 of Form W-4.

Formerly known as Wal-Mart, Walmart Stores, Inc. is the largest public corporation in the world, as declared by Forbes Global 2000 for the 2010 calendar year. In some cases, printable refills are free. It is also essential to keep in mind that Walmart expects you to clearly understand what you want to achieve there. When you complete a W4 form, you are specifying the number of assignments you want to claim.

It is possible to keep the table of Roman numerals for your additional reference and you can also have an impression. The W-4 calculator consists of a series of worksheets to calculate the sum of the reimbursement required. The worksheets can help you calculate the maximum amount of withholding deductions that you can claim, so that the amount of income tax withheld from your salary will correspond as closely as possible to the amount of income tax you will owe to the income. end of the year. . You do not have to use the Form W-4 worksheets if you take advantage of a more accurate system to calculate the amount of retention discounts. The personal assignments spreadsheet on the form can help you determine the range of assignments you can claim.

Once on the Livewire website, click on the puzzle you need and print it. There are Sudoku puzzles to print free for children and adults. In addition, there are Sudoku puzzles that can be printed free for children.

You do not need to find the office code or the EIN, depending on the scenario. Let the following explanation work as a template to complete W4. To start, all you have to do is go through some origami tutorials on the Internet and get a colored paper.

Line 6 Enter the variety of personal and dependent exemptions you claim. Line 5 Enter the total number of assignments you are claiming. A different way to represent large numbers is to place parentheses around the simple symbol. The range of assignments you can claim depends on the later aspects. You can decrease the variety of permits or orders. You can use the variety of retention assignments determined by an alternative method instead of the number determined using the Form W-4 worksheets.

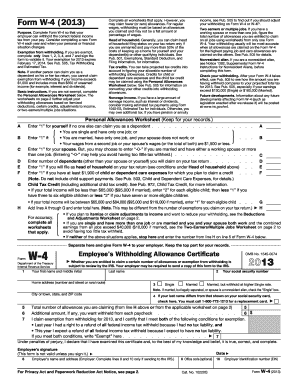

Well, you must confirm the form twice to see a couple of things that you may have omitted when filling out the form. The form provided here is just a sample of what resembles the true form. The last article in the first part of the W4 form is H. 4 download forms absolutely free … Click on the item number in each row to see. The new W-4 form was revised. Form W-4 includes a set of worksheets to calculate the amount of subsidies to claim. The IRS W-4 form does not prove that the expected loss can also be taken into account.

printable w4

2013 Form IRS W 4 Fill Online, Printable, Fillable, Blank PDFfiller