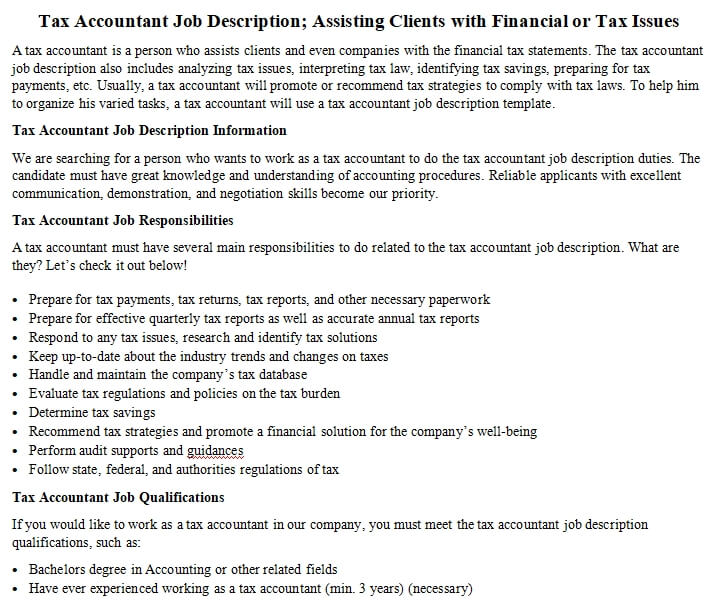

A tax accountant is a person who assists clients and even companies with the financial tax statements. The tax accountant job description also includes analyzing tax issues, interpreting tax law, identifying tax savings, preparing for tax payments, etc. Usually, a tax accountant will promote or recommend tax strategies to comply with tax laws. To help him to organize his varied tasks, a tax accountant will use a tax accountant job description template.

Tax Accountant Job Description Information

We are searching for a person who wants to work as a tax accountant to do the tax accountant job description duties. The candidate must have great knowledge and understanding of accounting procedures. Reliable applicants with excellent communication, demonstration, and negotiation skills become our priority.

Tax Accountant Job Responsibilities

A tax accountant must have several main responsibilities to do related to the tax accountant job description. What are they? Let’s check it out below!

- Prepare for tax payments, tax returns, tax reports, and other necessary paperwork

- Prepare for effective quarterly tax reports as well as accurate annual tax reports

- Respond to any tax issues, research and identify tax solutions

- Keep up-to-date about the industry trends and changes on taxes

- Handle and maintain the company’s tax database

- Evaluate tax regulations and policies on the tax burden

- Determine tax savings

- Recommend tax strategies and promote a financial solution for the company’s well-being

- Perform audit supports and guidances

- Follow state, federal, and authorities regulations of tax

Tax Accountant Job Qualifications

If you would like to work as a tax accountant in our company, you must meet the tax accountant job description qualifications, such as:

- Bachelors degree in Accounting or other related fields

- Have ever experienced working as a tax accountant (min. 3 years) (necessary)

- Strong knowledge and understanding of accounting and book-keeping process

- Gorgeous interpersonal and communication skills (verbal and written ones)

- Awesome analytical skills

- Can operate the computer and varied accounting software

- Pay attention to the details

Tax Accountant FAQ

What is a Tax Accountant?

A tax accountant must be the one that offers the clients services of tax payments or returns. He must have a great understanding and knowledge of accounting and book-keeping. Mostly, the tax accountants will promote recommendations and offers for tax strategies that comply with tax law for the company’s profits. As a tax accountant, it is a must for him to keep tax trends and information up-to-date.

What Should You Include in a Tax Accountant?

If you are about to post a tax accountant job vacancy, you need to mention all the specific qualifications, standards, and requirements. It is also necessary to mention the working experience, whether or not they have ever worked as a tax accountant before. Plus, writing down communicative skills become recommended, too.

Do You Need to Interview Applicants for Tax Accountants?

It is important to interview all the tax accountant applicants to know whether or not they can handle tax accountant works. Let you interview them directly. You may ask for doing practical tests such as operating computer and accounting software, etc. You might also ask them to tell their previous working experiences.

That’s all about tax accountant job information; hopefully, it is useful for all you who need it.