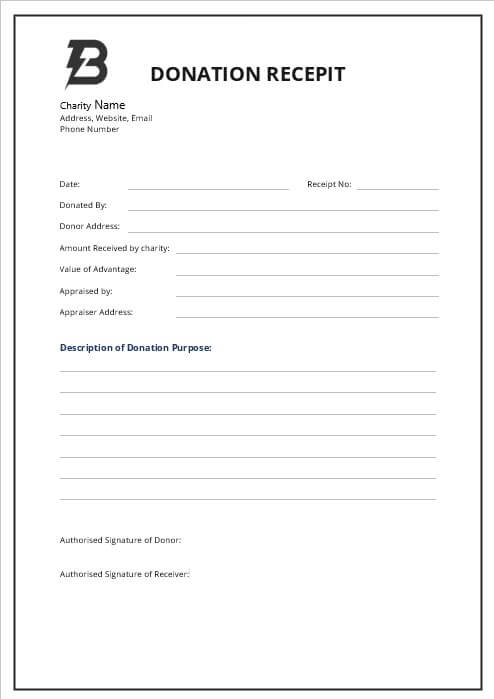

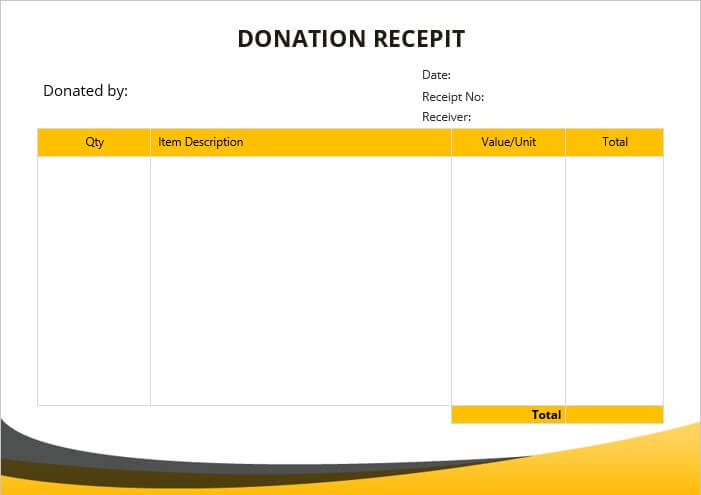

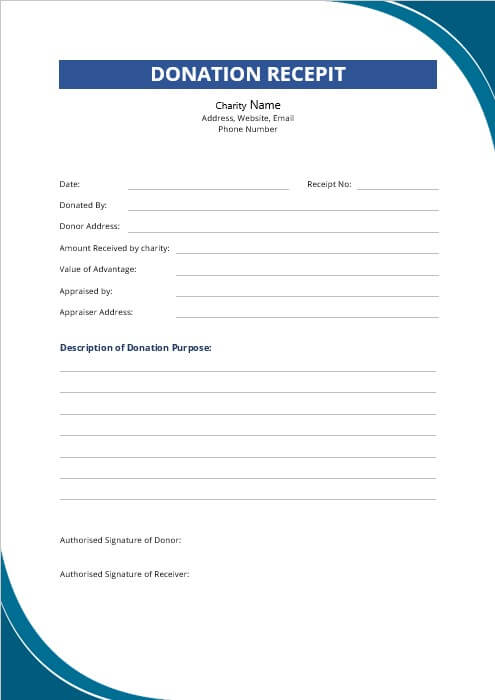

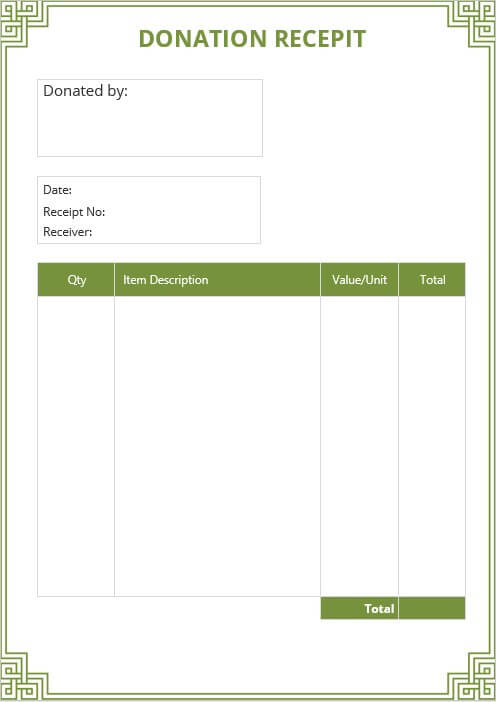

Charitable Donation Receipt Template and tips to make it great

When you are arranging a nonprofit organization, you probably need to arrange a charitable donation receipt template. This template is important to arrange because it will help you to know the donation that you get from any people or organization. Therefore, you have to arrange this template properly.

What is a charitable donation receipt template?

You need to consider that nonprofit professional will face multiple competing demands on time and often under a lot of pressure. It can be easy to think nonprofit donation receipt is not important. The charitable donation receipt template idea will be important because it will help you to cover your base with the IRS well.

- Residential Aide Job Description and Relevant FAQs

- Draftsman Job Description and Its Responsibilities

- YouTuber Job Description and Its FAQ

- Purchasing Specialist Job Description and Its Requirements

- 5+ Auto Insurance Card psd template free

How to create a charitable donation receipt template

Moreover, the charitable donation receipt template format also will help you to track the donation and it will be crucial to a successful donor relationship. Therefore, you need to make this format central to effective fundraising. You also have to know the general rule that is only formed in the United States.

When you arrange this charitable donation receipt template design, you need to understand the basic donation requirements. In this part, here are some steps that will make your template impressive to read.

- You can begin your template with the name of the organization to which the donation has been made and the statement that nonprofit is a public charity recognized as text-exempt

- Remember to include the name of the donor and the date of the donation was received to make it easily understanding

- You also need to include the amount of cash contribution and a description of any non-cash contribution because nonprofit should not attempt to assign the cash value of property

- You also need to write the statement that no goods or services are provided by the organization on the template

Tips to arrange a charitable donation receipt template

Furthermore, you also will need some tips when you are designing the charitable donation receipt document template. The tips will make your template impressive and it will make your document template awesome. Here are some of the tips that should be followed on your template.

- You should never state on the donation receipt that a contribution is a deductible based on the donor’s particular tax situation

- You also need to keep the gift top of mind that is an important step to ask for a donation in the future

- You also have to show your response that your nonprofit is responsive and appreciative to make the people easily understand your template

- You can create and customize the draft of your receipt content and you can populate it automatically with all the necessary donation details and organization info

Turn the Charitable Donation Receipt Template into Engagement Piece

Finally, you only need to turn them into an engagement piece. In this idea, your charitable donation receipt template can be asked yourself what makes you want to dive deeper. You also can include the testimonials from your staff, volunteers, or even the beneficiaries. Those ideas will make your template impressive to read.