Borrowing is a common thing in business. It is different with the personal borrowing matter, in business, there should be a loan agreement letter to make sure there is a clear line between two parties. This agreement will be the basic on how both parties resolve the conflicts and fulfill the obligation. On this article, we will discuss more about this type of letter.

What Is A Loan Agreement?

A loan agreement is a document that rule out the terms and condition between lender and borrower. In this agreement, the borrower must agree that he or she will return the loan based on the scheduled dates. For the lender, this agreement is useful as the legal proof that the borrower has agreed the terms and condition discussed. Besides, it is a legally binding document so if one the party breaches the agreement, another one can resolve it in the court.

What Do You Need To Include In The Loan Agreement Letter?

Keep in mind when writting a loan letter agreement, you must make it clear, straightforward and avoid words that have ambiguity meaning. In this case, many people fall onto problems due to the poor agreement arrangements. You can ask your personal attorney to help you arrange an agreement professionally.

- Veterinary Technician Job Description and Its Requirements

- Songwriter Job Description and Its Requirements

- Youth Sports Coach Job Description and Its Tasks & Duties

- Optician Job Description and Its Tasks & Duties

- Transcriber Job Description and Its FAQ

Speaking about the aspects of the agreement, you need to include the following aspects.

The location

If the document is for loan agreement, the lender can pick the location. If this agreement is for assets purchasing, taking the property address as the place to be written in the document is much better.

Lender and borrower details

This include the name of each partu, address, contact person, co-signer and so on.

The loan amount

State clearly the amount of the loan in numerical and words to avoid any mishandling document.

Interest and late fees

State also certain terms such as late payments, interest and another things related with payment terms.

The Example Of A Loan Agreement Letter

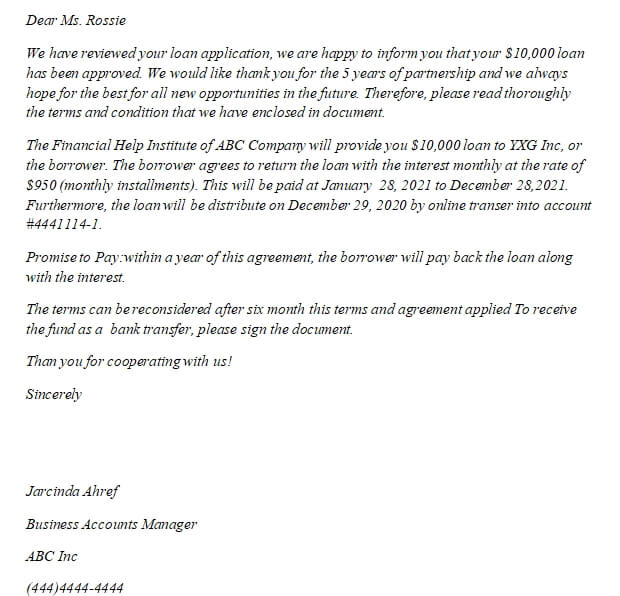

Dear Ms. Rossie

We have reviewed your loan application, we are happy to inform you that your $10,000 loan has been approved. We would like thank you for the 5 years of partnership and we always hope for the best for all new opportunities in the future. Therefore, please read thoroughly the terms and condition that we have enclosed in document.

The Financial Help Institute of ABC Company will provide you $10,000 loan to YXG Inc, or the borrower. The borrower agrees to return the loan with the interest monthly at the rate of $950 (monthly installments). This will be paid at January 28, 2021 to December 28,2021. Furthermore, the loan will be distribute on December 29, 2020 by online transer into account #4441114-1.

Promise to Pay:within a year of this agreement, the borrower will pay back the loan along with the interest.

The terms can be reconsidered after six month this terms and agreement applied To receive the fund as a bank transfer, please sign the document.

Than you for cooperating with us!

Sincerely

Jarcinda Ahref

Business Accounts Manager

ABC Inc

(444)4444-4444

I understand and agree with the terms and condition stated on this loan agreement letter. I also agree will pay the loan with interest under this term and condition.

—————————————————-

Rossie Cloonie

Owner

XYG Inc

Date: ————–